2025 Cross-Chain Bridge Security Audit Guide

2025 Cross-Chain Bridge Security Audit Guide

According to Chainalysis data from 2025, a staggering 73% of cross-chain bridges show vulnerabilities that could lead to significant financial losses. In this rapidly evolving crypto landscape, ensuring the security of your investments is crucial, and tools like HIBT crypto portfolio tracker can help you navigate these risks effectively.

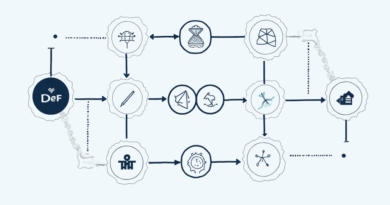

Understanding Cross-Chain Bridges

Think of cross-chain bridges as currency exchange booths at the airport. You wouldn’t hand your cash to just anyone for an exchange, right? Similarly, not all cross-chain bridges are secure. In 2025, the rise in DeFi applications using these bridges has increased their target on the hack radar. So, how do you ensure your assets remain safe while taking advantage of these technologies?

The Importance of Security Audits

The best way to understand the robustness of a cross-chain bridge is through comprehensive security audits. Just as you would check a restaurant’s reviews before dining, you should look into audit reports for each bridge you consider. A trustworthy audit can delve into vulnerabilities and offer insights into mitigating risks. Using HIBT crypto portfolio tracker can also help you keep track of where your assets are at all times, adding another layer of security.

Evaluating Risk with Zero-Knowledge Proofs

Have you ever heard someone talk about zero-knowledge proofs? It’s like proving you have the keys to your house without showing anyone the actual keys. These proofs allow for secure transactions without exposing underlying data. With more projects adopting zero-knowledge proofs in their design, the security of cross-chain interactions is set to improve, making tools like HIBT crypto portfolio tracker essential for tracking performance.

The Future of Regulatory Trends in Singapore

As we move into 2025, Singapore is paving the way for DeFi regulations. This is crucial—much like how traffic laws help keep pedestrians safe. With likely policies emerging, having your investments managed through reliable platforms can ensure compliance and protection against unforeseen regulations. Big players would benefit from deploying trackers like HIBT crypto portfolio tracker to stay informed and compliant.

Conclusion

In conclusion, as cross-chain technology evolves, so does the landscape of security and regulation. Protecting your investments requires due diligence and the right tools. If you’re serious about safeguarding your crypto portfolio, download our free toolkit today and check out our in-depth white papers at hibt.com for more guidance.