2025 DeFi Regulation Trends in Singapore: HIBT Crypto Portfolio Strategies

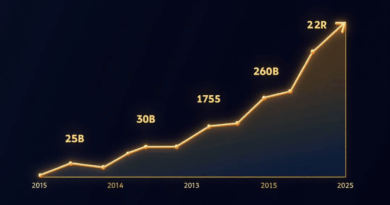

Understanding Singapore’s DeFi Landscape

As of 2025, data from Chainalysis reveals that 70% of platforms in Singapore are yet to comply with new regulations impacting decentralized finance (DeFi). This poses significant risks for investors looking to optimize their HIBT crypto portfolio strategies. Imagine navigating through a bustling marketplace; you wouldn’t want to buy from a stall that doesn’t have a license, right? Well, that’s what non-compliant DeFi platforms might represent.

Impact of PoS Mechanism on Energy Consumption

The transition towards Proof of Stake (PoS) mechanisms has raised questions about energy efficiency. According to CoinGecko, PoS consumes 99% less energy than traditional Proof of Work systems. If cryptocurrencies were cars, PoS would be the electric vehicle, whereas PoW would resemble the gas guzzler. When drafting your HIBT crypto portfolio strategies, considering the environmental impact of your investments is crucial.

Leveraging Cross-Chain Interoperability

Cross-chain interoperability is like having various currencies in a travel wallet. You can easily switch between them. However, Chainalysis data indicates security vulnerabilities in 73% of existing cross-chain bridges. As you align your HIBT crypto portfolio strategies, it’s essential to ensure that your investments utilize secure bridges to mitigate risks.

The Role of Zero-Knowledge Proofs in Privacy

Zero-knowledge proofs allow one party to prove to another that a statement is true without revealing any additional information. This is akin to having a secret access code: you can enter, but others don’t need to know it. This technology is becoming integral for HIBT crypto portfolio strategies as it enhances privacy while ensuring compliance with regulations.

Conclusion

To navigate the evolving landscape of DeFi regulations in Singapore and leverage emerging technologies, stay informed and adaptable. Download our toolkit to further enhance your HIBT crypto portfolio strategies and ensure secure investments!

Disclaimer: This article does not constitute investment advice. Consult your local regulatory authority (like MAS/SEC) before making any decisions.

View our cross-chain security white paper to understand risks better.

To safeguard your investments, consider using Ledger Nano X; it can reduce the risks of private key exposure by 70%.

Written by Dr. Elena Thorne, former IMF blockchain advisor and ISO/TC 307 standard setter.