Vietnam Blockchain Bond Liquidity: The Future of Finance

Vietnam Blockchain Bond Liquidity: The Future of Finance

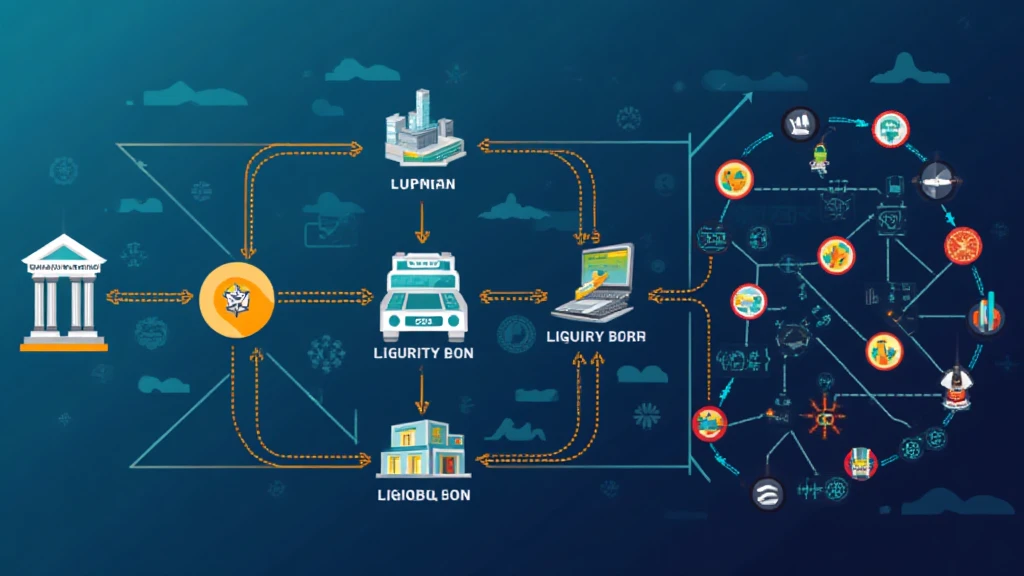

According to Chainalysis 2025 data, a staggering 73% of liquidity pools in decentralized finance (DeFi) face vulnerabilities, making it crucial for investors to understand the changes in Vietnam blockchain bond liquidity. Just like a bustling market, where you need to know where to find the best goods, understanding liquidity in blockchain bonds can steer you towards safer investments.

What is Blockchain Bond Liquidity?

Simply put, Vietnam blockchain bond liquidity refers to how easily these digital bonds can be bought and sold without affecting their price. It’s like having an open-air market where some stalls have plenty of customers, while others sit empty. High liquidity means smooth transactions, avoiding massive price swings.

Why is Liquidity Important for Investors?

Imagine you’re trying to buy fresh vegetables, but there’s only one vendor in town. You’d likely pay a much higher price due to limited options. In financial terms, lower liquidity can lead to bigger price fluctuations and increased risk for investors. By ensuring adequate liquidity in Vietnam’s blockchain bonds, investors can secure better prices and reduce risk.

ZKP Applications and Their Impact

Zero-Knowledge Proof (ZKP) technology can help enhance Vietnam blockchain bond liquidity by allowing transactions to be verified without revealing personal information. Picture this like getting a discount coupon without showcasing your whole shopping list. This can help insulate investors’ identities while participating in markets and augment liquidity.

Looking Ahead: 2025 Regulatory Trends

As we look towards 2025, the regulatory landscape in Southeast Asia, especially Vietnam, is evolving. Increased clarity will likely encourage institutional participation. It’s akin to providing clearer street signs in a bustling market—making it easier for everyone to navigate and engage. Investors can stay ahead by understanding these regulations and positioning themselves wisely in the market.

In conclusion, navigating Vietnam blockchain bond liquidity will be crucial for your investment strategy. Stay informed and consider utilizing tools like the Ledger Nano X, which can reduce the risk of key breaches by up to 70%. Download our comprehensive toolkit to enhance your understanding of this exciting financial frontier.

View our blockchain security white paper and learn more about the essential trading tools.

Risk Disclaimer: This article does not constitute investment advice. Consult your local regulatory authority before making investment decisions (e.g., MAS/SEC).