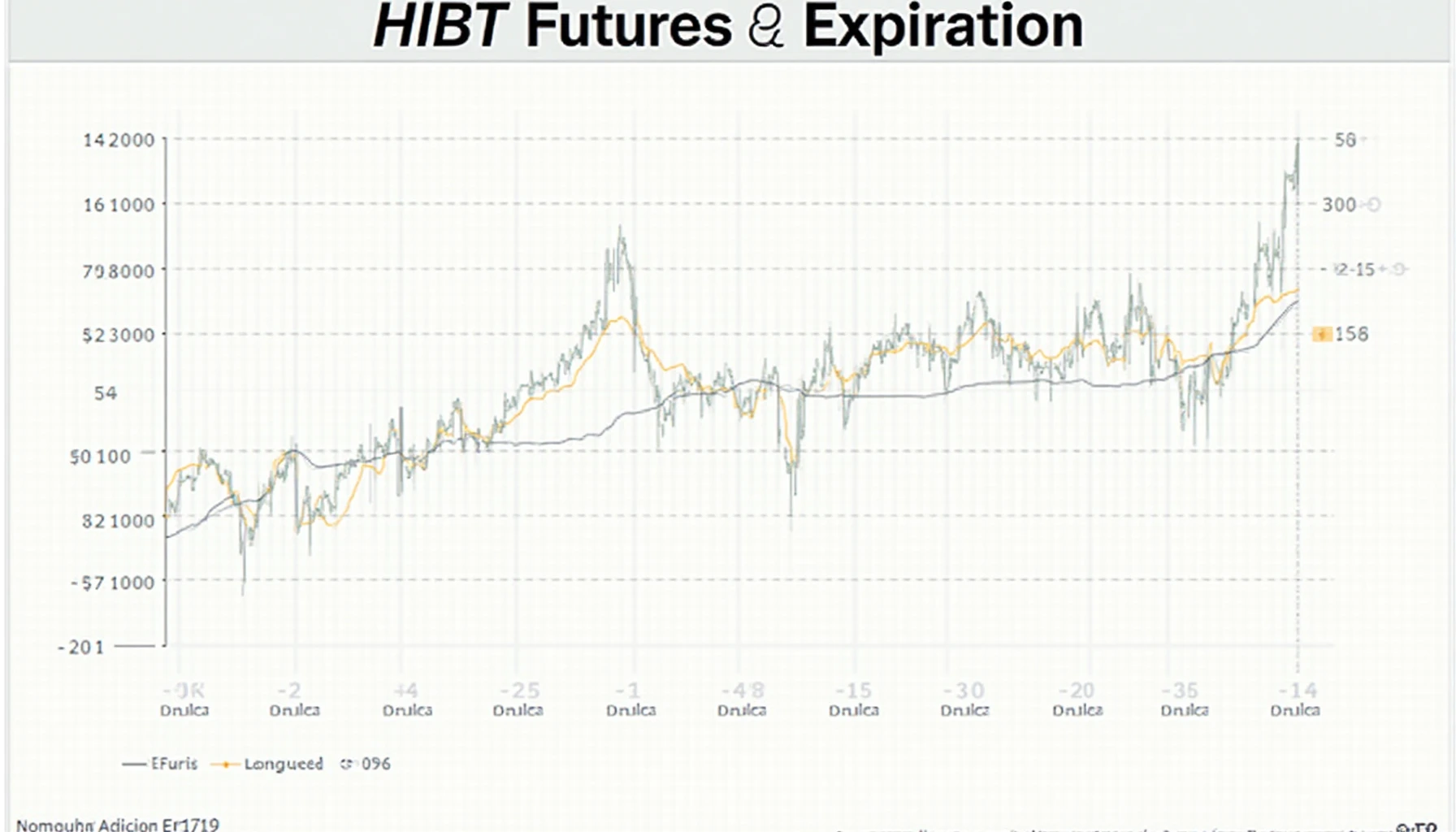

Understanding HIBT Bitcoin Futures Expiration

Introduction to HIBT Bitcoin Futures

As of 2024, the cryptocurrency industry is thriving, with over $4.1 billion lost to hacks in decentralized finance (DeFi) platforms. Investors are increasingly curious about the mechanics behind Bitcoin futures and how expiration dates can affect market dynamics. This article dives into the concept of HIBT Bitcoin futures expiration, exploring its implications for both traders and investors.

What is HIBT Bitcoin Futures?

HIBT Bitcoin futures are contracts that allow traders in the cryptocurrency market to speculate on the future price of Bitcoin. By agreeing to buy or sell Bitcoin at a predetermined price at a set date, traders can hedge against market volatility. The expiration of these futures is a critical event that often leads to significant price movements.

Why Does Futures Expiration Matter?

When futures contracts near expiration, they create unique market pressures. Traders may close their positions, leading to increased volatility. Here’s a quick breakdown of the potential impacts:

- Price Volatility: Close to expiration, the demand for Bitcoin can rapidly shift, causing spikes or drops.

- Market Liquidity: Increased trading activity around expiration can either enhance or diminish market liquidity.

- Investor Sentiment: The outcome of futures expiration can influence broader market sentiment regarding Bitcoin.

Analyzing Trading Strategies Around Expiration

Market participants often deploy various strategies as expiration dates approach. For instance, some traders choose to roll over their contracts to avoid settlement, while others take advantage of the price shifts that occur. Here’s a comparison:

- Rolling Over: This strategy involves closing out an expiring contract and opening a new one. It helps maintain exposure without facing potential losses due to expiration.

- Short Selling: Traders may decide to short the asset based on patterns observed before and during the expiration period.

The Growing Vietnamese Market

In 2024, Vietnam has seen a **60% increase** in the number of crypto users, spurred by the recent interest in Bitcoin futures. As the market expands, understanding the implications of HIBT Bitcoin futures expiration becomes ever more crucial for local investors. Additionally, the Vietnamese government has been scrutinizing the industry heavily, with initiatives to increase compliance – tiêu chuẩn an ninh blockchain are now more important than ever.

Conclusion: The Future of HIBT Bitcoin Futures

As the implementation of Bitcoin futures continues to evolve globally, it’s essential for traders and investors to keep an eye on expiration dates and their implications. Understanding these mechanics not only helps mitigate risk but also enhances strategic planning. Remember, whether you are long or short on Bitcoin, staying informed is key. Visit HIBT for more insights and to download our latest guides on trading strategies.