2025 Altcoin Exchange Order Book Analysis Guide

2025 Altcoin Exchange Order Book Analysis Guide

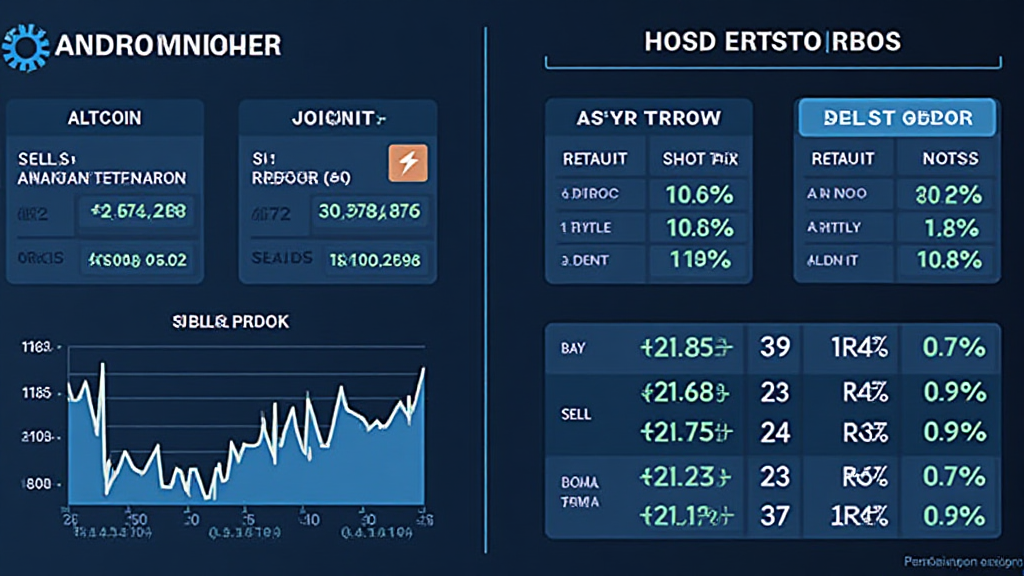

According to Chainalysis data for 2025, a staggering 73% of altcoin exchanges are vulnerable to security breaches. This highlights a pressing issue for traders navigating the altcoin landscape. Understanding the order book dynamics of altcoins is more vital than ever to mitigate risks and enhance trading efficiency.

What is an Altcoin Exchange Order Book?

Think of an altcoin exchange order book like a busy marketplace where various vendors (traders) set up stalls and list their items (orders) for sale. Just as you can see the prices and quantities of goods available, an order book displays current buy and sell orders for altcoins. This transparency helps traders decide the best times to enter or exit positions, just like when you might wait for the right price before buying those fresh vegetables.

How Do Order Books Impact Trading Strategies?

Imagine you’re in a local market under the scorching sun, trying to find the best deal on your favorite fruits. Just like you would watch other shoppers and their purchase decisions, traders analyze order books to gauge market sentiment. A robust order book can suggest high liquidity, which means easier buying and selling without affecting the price too much. In contrast, a thin order book might indicate potential volatility—traders should proceed with caution, much like how you would check if a vendor is reputable before making a purchase.

Exploring Cross-Chain Interoperability

Cross-chain interoperability in altcoin exchanges is reminiscent of the way different currencies are exchanged at a travel bureau. For instance, if you want to exchange your dollars for euros, the travel bureau provides the best rates based on market demand. Similarly, cross-chain technologies allow different blockchains to communicate and transact efficiently, enhancing liquidity across platforms. However, as we await regulatory frameworks in different regions, such as Singapore, the market faces uncertainties.

The Role of zk-SNARKs in Securing Order Books

Using zero-knowledge proofs (zk-SNARKs) is like a trusted friend vouching for you without disclosing sensitive details to a stranger. They allow for trades to be verified while keeping transaction details private. This technology can help secure altcoin exchange order books from malicious actors and ensure that sensitive user information remains confidential. The analysis of order books, considering zk-SNARKs, is essential for traders to stay ahead in the potentially risky world of altcoin trading.

In conclusion, a thorough understanding of the altcoin exchange order book analysis is crucial for navigating the complexities of 2025’s trading landscape. For a deeper dive into effective trading strategies, download our free toolkit today!

Disclaimer: This article does not constitute investment advice. Please consult local regulatory authorities, such as MAS or SEC, prior to making investment decisions. To mitigate risks, consider using hardware wallets like Ledger Nano X to reduce the risk of private key exposure by up to 70%.