2025 Guide to Altcoin Liquidity Pools HIBT

2025 Guide to Altcoin Liquidity Pools HIBT

According to Chainalysis 2025 data, a staggering 73% of Altcoin liquidity pools are vulnerable to exploitation. This alarming statistic highlights the urgent need for improved security measures, especially within the realm of decentralized finance (DeFi). The concept of liquidity pools in the altcoin space has evolved significantly, and understanding their functionality can be key for investors and traders alike.

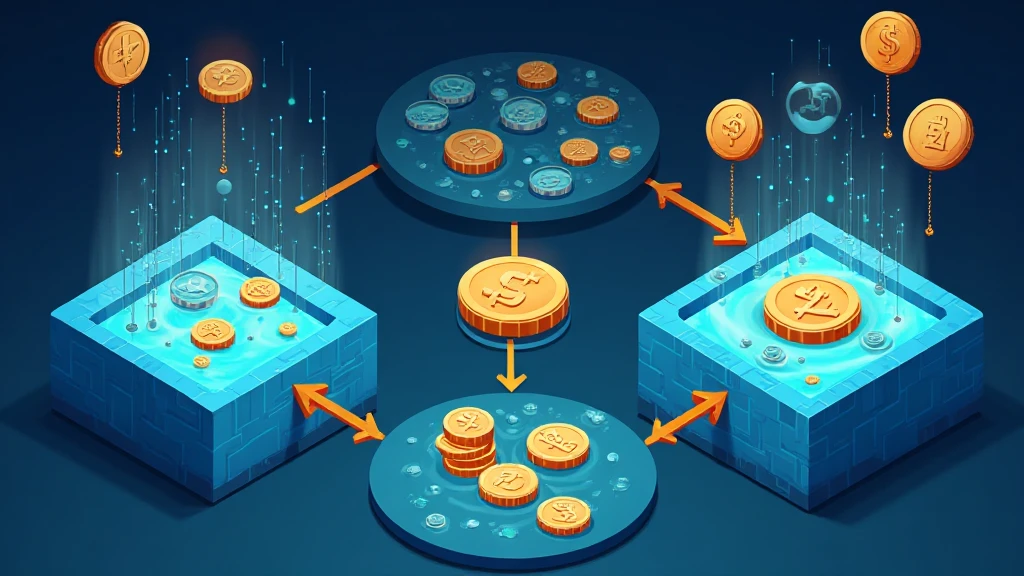

What are Altcoin Liquidity Pools?

Imagine you’re at a local market, and you want to exchange some apples for oranges. The vendor has set up a stand to facilitate these trades, just like how an altcoin liquidity pool allows users to trade different cryptocurrencies. These pools provide the necessary liquidity to enable seamless transactions by pooling funds together, creating availability for users looking to swap tokens.

Why Are They Vulnerable?

Much like an unmonitored market stall where anyone can come and tamper, liquidity pools can be susceptible to hacks and exploits. Security audits are essential, but studies show that only about 27% of these altcoin pools undergo thorough scrutiny. This lack of due diligence opens the door for potential breaches, leading to loss of funds for participants.

How Can We Improve Security?

One effective solution for enhancing the security of altcoin liquidity pools is implementing updated smart contracts that include zero-knowledge proofs. Think of this as adding a security system to your vendor stall—only authorized individuals can access the cash box, greatly reducing theft risk. Zero-knowledge proofs allow for verification without revealing private information, thus bolstering trust among users.

Future Trends and Regulations

The DeFi landscape is rapidly evolving, especially with the upcoming regulatory frameworks expected to be established in regions like Singapore. By 2025, new regulations will likely impose standards on how liquidity pools operate, focusing on transparency and security. Staying informed about these trends can mean the difference between a smart investment and a risky gamble.

In summary, while Altcoin liquidity pools HIBT offer exciting opportunities for trading and investment, they also come with significant risks. Educating oneself about vulnerabilities and actively seeking out safe trading practices—such as using secure hardware wallets like Ledger Nano X—is vital. Download our comprehensive toolkit to stay ahead in the crypto landscape.

Disclaimer: This article is not investment advice. Please consult your local regulatory authorities (like MAS/SEC) before making any investment decisions.