Understanding B2B vs B2C Business Models in Cryptocurrency

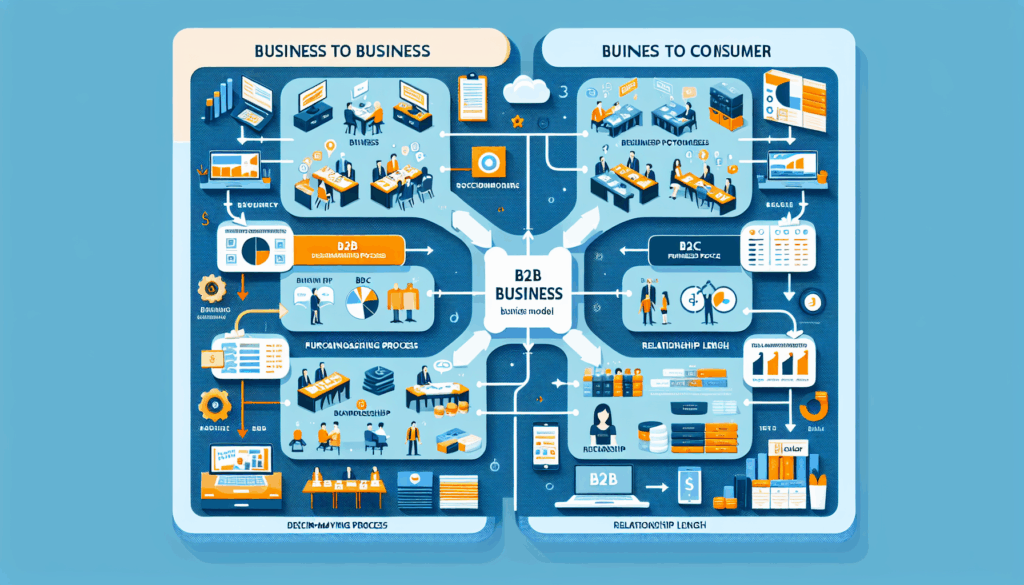

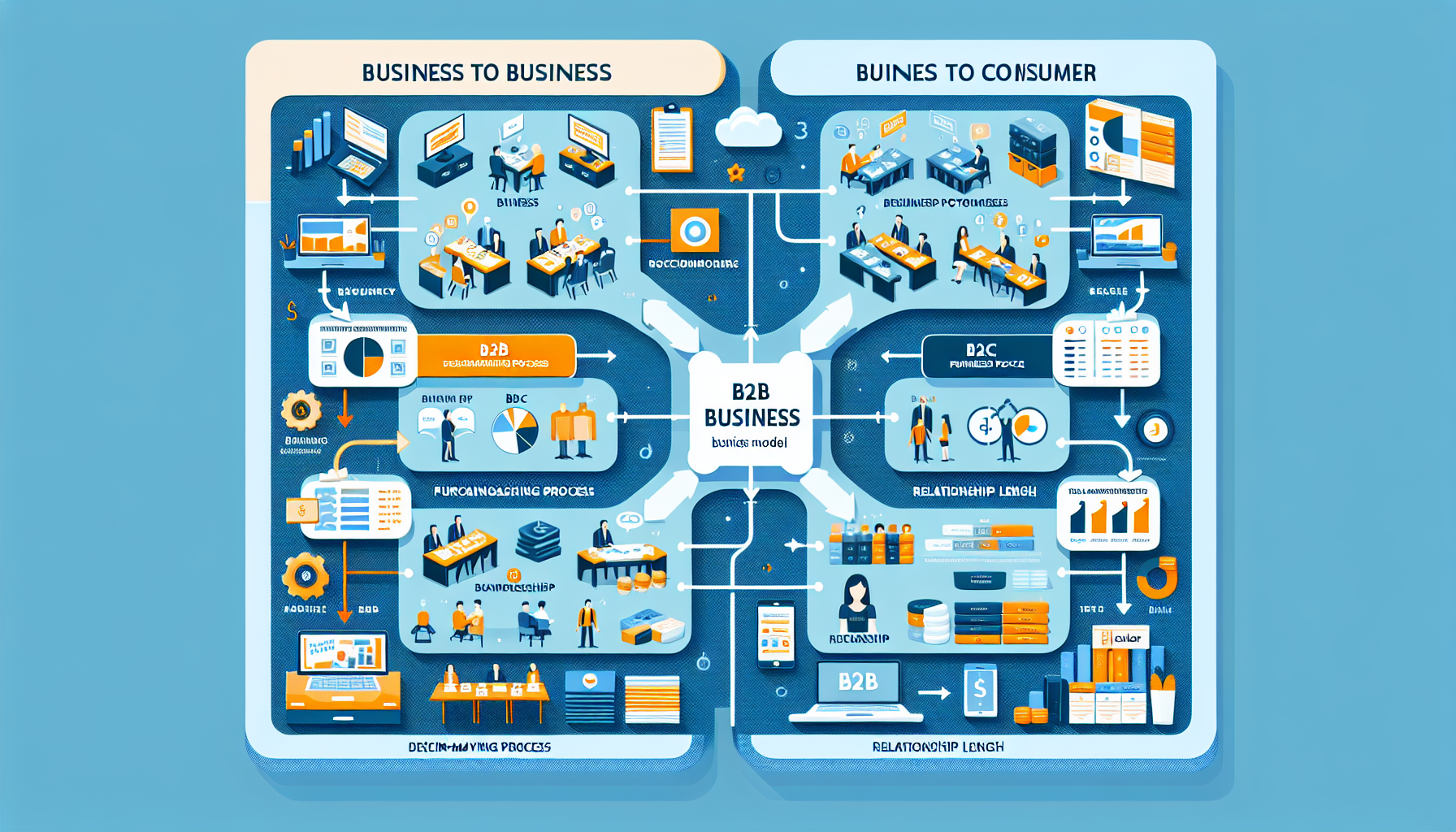

B2B vs B2C Business Models in Cryptocurrency

In today’s digital economy, understanding the difference between B2B (Business to Business) and B2C (Business to Consumer) business models is crucial for companies operating in the cryptocurrency sector. Both models demand tailored strategies to tackle unique pain points like customer acquisition and regulatory compliance. In this article, we will analyze these two approaches to help you make informed decisions for your cryptocurrency venture.

Pain Points in B2B vs B2C Business Models

For businesses in the cryptocurrency realm, whether you are targeting enterprises (B2B) or individual consumers (B2C), challenges abound. B2B companies often struggle with long sales cycles and establishing trust, while B2C companies face obstacles like high customer churn rates and fierce competition in attracting attention. For instance, a leading B2B cryptocurrency exchange might find difficulty in penetrating markets with established financial providers, whereas a B2C wallet application could grapple with maintaining daily active user rates.

Solution Analysis

To differentiate effectively between B2B vs B2C business models, it’s vital to implement specific strategic methods. Here are some highlighted steps:

- Define Audience Needs: Ensure that your products address the specific pain points of either businesses or individual consumers.

- Customization and Personalization: B2B models may require tailored solutions, while B2C often thrives on personalized user experiences.

- Leverage Data Analytics: Use data-driven insights to adapt to market dynamics and optimize offerings.

| Parameter | B2B Model | B2C Model |

|---|---|---|

| Security | Higher emphasis on secure networks and **multi-signature verification** | Focus on user-friendly security practices and educational resources |

| Cost | Higher operational costs with lower margins | Lower setup costs with scalability potential |

| Applicable Scenarios | Ideal for large transactions and established partnerships | Great for high-volume consumer engagement and retention |

According to a recent Chainalysis report, by 2025, the expected transactions in B2B crypto markets will rise significantly, indicating an evolving landscape where businesses will increasingly adopt blockchain technologies for seamless transactions.

Risk Warnings

Both B2B and B2C models offer distinct risks. **Regulatory compliance issues** can pose significant threats. Companies must constantly monitor regulations, ensuring they remain compliant to avoid hefty penalties. **Data security breaches** are another critical risk; businesses must invest in robust security measures to protect sensitive user information.

In conclusion, understanding the nuances of B2B vs B2C business models is vital for any cryptocurrency enterprise. Tailored strategies, customer focus, and consistent innovation will dictate success in navigating this competitive landscape. For expert insights and further information, consider visiting thedailyinvestors, a platform dedicated to cryptocurrency education.

FAQ

Q: What is the main difference between B2B and B2C in cryptocurrency?

A: The primary difference lies in their target audience; B2B focuses on businesses while B2C caters to individual consumers. Each requires unique approaches to address distinct needs.

Q: Why is understanding these business models crucial?

A: Understanding B2B vs B2C business models is important for optimizing marketing strategies and ensuring product-market fit in the ever-changing cryptocurrency environment.

Q: How can businesses mitigate risks in cryptocurrency?

A: Companies should prioritize regulatory compliance, invest in cybersecurity, and utilize comprehensive market analysis strategies to mitigate risks in both B2B and B2C transactions.

Expert Author: Dr. John A. Carter, a cryptocurrency analyst with over 15 published papers in blockchain technology and a strategic auditor for high-profile cryptocurrency projects.