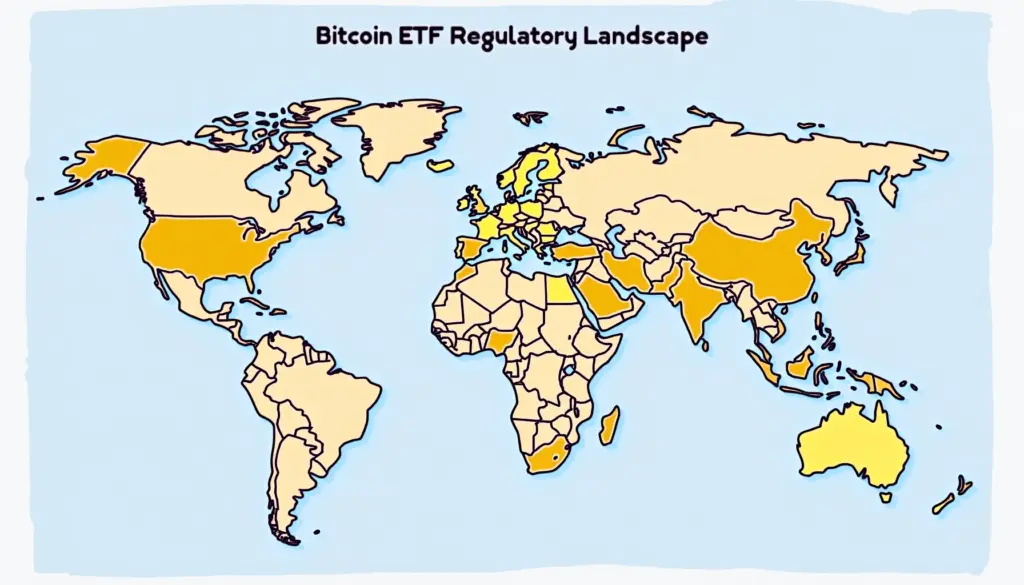

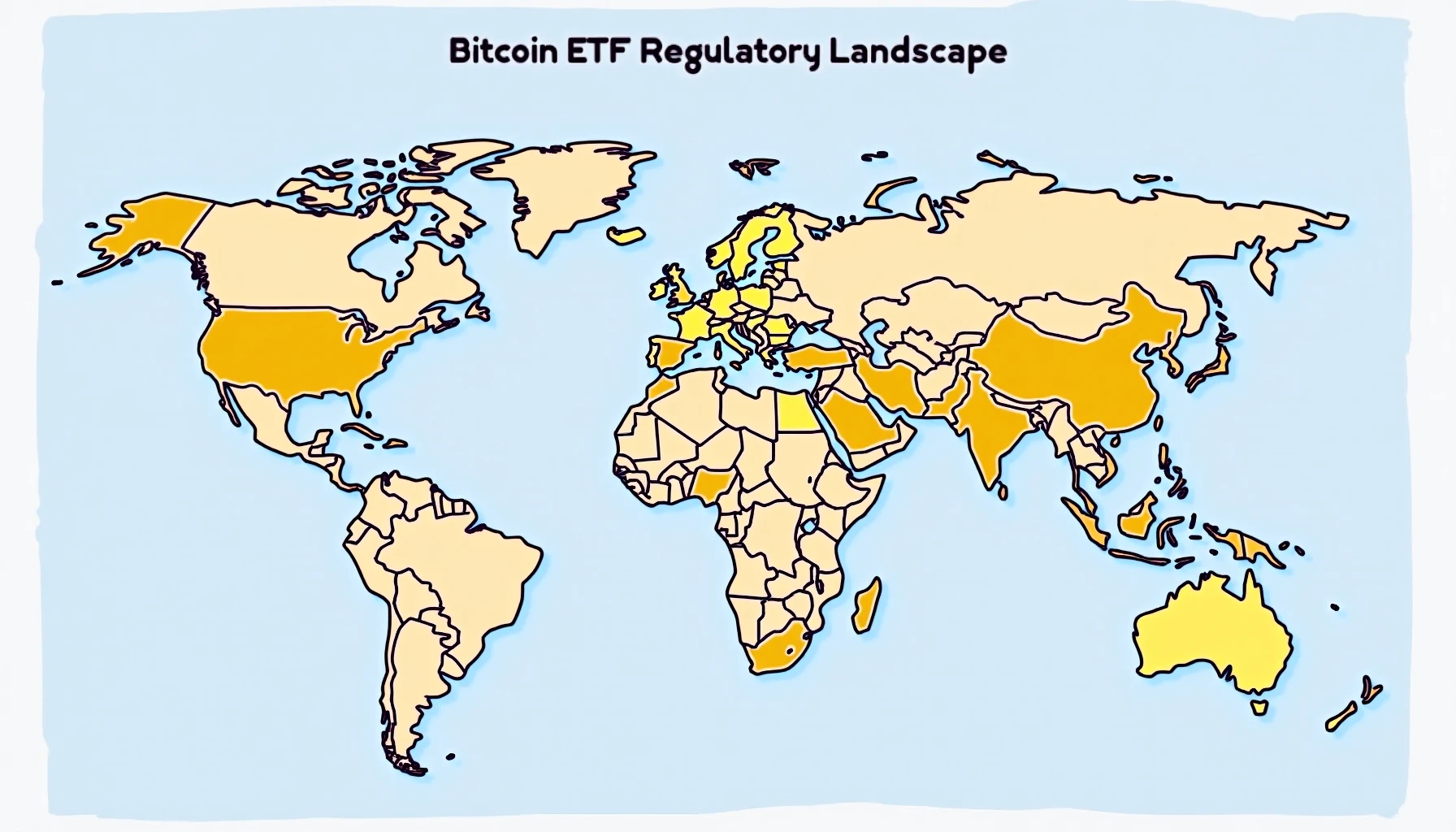

Bitcoin ETF Regulatory Landscape

Bitcoin ETF Regulatory Landscape

With Bitcoin witnessing unprecedented growth over the past decade, the regulatory landscape surrounding Bitcoin ETFs has become increasingly important. In 2024 alone, over $4.1 billion were lost to DeFi hacks, prompting a surge in demand for regulated investment vehicles like Bitcoin ETFs.

Understanding Bitcoin ETFs

Bitcoin ETFs (Exchange-Traded Funds) allow investors to gain exposure to Bitcoin without owning the cryptocurrency directly. This is similar to how individuals can invest in gold through ETFs without holding physical gold. The appeal lies in the regulatory scrutiny and investor protections that come with ETFs.

The Current Regulatory Climate

As of 2025, the Bitcoin ETF regulatory landscape is complex and varies significantly by region. In the United States, the SEC has recently begun to approve Bitcoin ETFs, a move that reflects growing acceptance. Conversely, in Vietnam, where the government is exploring regulations for cryptocurrencies, the adoption of Bitcoin ETFs remains in its infancy.

Global Comparison and Trends

Countries like Canada and Europe have seen successful Bitcoin ETF launches. For instance, the Purpose Bitcoin ETF was the first in North America, which has seen significant inflows since its inception. Meanwhile, Vietnam’s cryptocurrency market has been experiencing a user growth rate of over 30% annually, indicating a promising future for Bitcoin ETFs.

Challenges Ahead

Despite the potential, challenges remain for Bitcoin ETFs. Regulatory clarity is crucial. Each country’s regulations lead to different compliance requirements, impacting the launch and management of these funds. Moreover, global data indicates that regulatory delays can lead to lost investor confidence.

The Future of Bitcoin ETFs

Looking ahead, the Bitcoin ETF regulatory landscape is expected to evolve. Analysts suggest that by 2026, more countries may follow suit in approving Bitcoin ETFs, creating opportunities for investors across the globe, including in Vietnam. Like a bank vault for digital assets, a regulated ETF offers greater security to investors.

In conclusion, the Bitcoin ETF regulatory landscape is rapidly changing, and staying informed is key for prospective investors. With the right information, you can navigate this exciting frontier confidently.

For further insights, feel free to download our security checklist to protect your investments.

This is not financial advice. Consult local regulators for guidance.

Author: Dr. Nguyen Hoang Minh, a blockchain expert with over 15 published papers and has led audits on several prominent cryptocurrency projects.