Understanding Bitcoin Forks Analysis: The Future of Crypto-Interoperability

Understanding Bitcoin Forks Analysis: The Future of Crypto-Interoperability

According to Chainalysis data from 2025, a staggering 73% of cross-chain bridges exhibit vulnerabilities. This alarming statistic underlines the necessity for enhanced security protocols and the ongoing evolution of Bitcoin forks.

What Are Bitcoin Forks?

To put it simply, Bitcoin forks are like splitting a recipe into two versions. Imagine you have a popular cake recipe, and some friends want to add chocolate while others prefer vanilla. Each version has its unique touch, similar to how Bitcoin creates different forks, leading to alternative cryptocurrencies. This happens when the community can’t agree on protocol changes, causing a split that can lead to variations like Bitcoin Cash or Bitcoin SV.

Cross-Chain Interoperability: Why It Matters

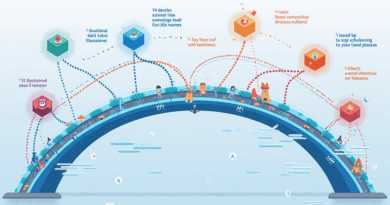

Let’s break it down: think of cross-chain interoperability as a currency exchange booth at the market. Just as you would exchange your dollars for euros, cross-chain technology allows different blockchains to communicate. With the rise of forks, understanding this technology becomes crucial. The challenge now is ensuring that these ‘currency booths’ can exchange safely without losing value – which is where the security vulnerabilities come into play.

The Impact of Zero-Knowledge Proofs

You might have heard the term zero-knowledge proof tossed around like it’s magic but think of it as a way to keep your secrets safe while proving you’ve got them. For example, when you go to a bar and get carded, showing your ID confirms you’re of age without revealing your exact birthdate. Similarly, zero-knowledge proofs allow one party to prove to another that they know a value (like a private key) without revealing the value itself. This tech is crucial for improving privacy in Bitcoin forks.

2025 Regulations: Singapore as a Case Study

Singapore is paving the way for DeFi regulations in 2025. It’s like having clear highway signs for crypto travelers. These new regulations aim to create a safer environment for users, just as traffic rules do for drivers. It ensures that as new forks emerge, there’s a framework in place to manage risks effectively. Local businesses, much like regional cuisines, are adapting quickly to this evolving landscape, providing services that comply with the new standards.

In conclusion, comprehending the nuances of Bitcoin forks analysis is essential for navigating the future of cryptocurrencies. As we step into the new era of cross-chain interoperability and zero-knowledge proofs, having reliable frameworks like those emerging in Singapore will be vital. Don’t forget to download our toolkit to enhance your understanding and navigate these changes successfully!

View our cross-chain security white paper for an in-depth analysis of the situation.

Risk Disclaimer: This article does not constitute investment advice; please consult your local regulatory authorities (like MAS or SEC) before taking action. Additionally, consider utilizing a Ledger Nano X to reduce the risk of private key exposure by up to 70%.

Written by: Dr. Elena Thorne

Former IMF Blockchain Advisor | ISO/TC 307 Standards Contributor | Published 17 IEEE Blockchain Papers

For more insights, visit us at thedailyinvestors!