2025 Bitcoin Liquidity HIBT Platform Insights

Exploring Bitcoin Liquidity on HIBT Platform

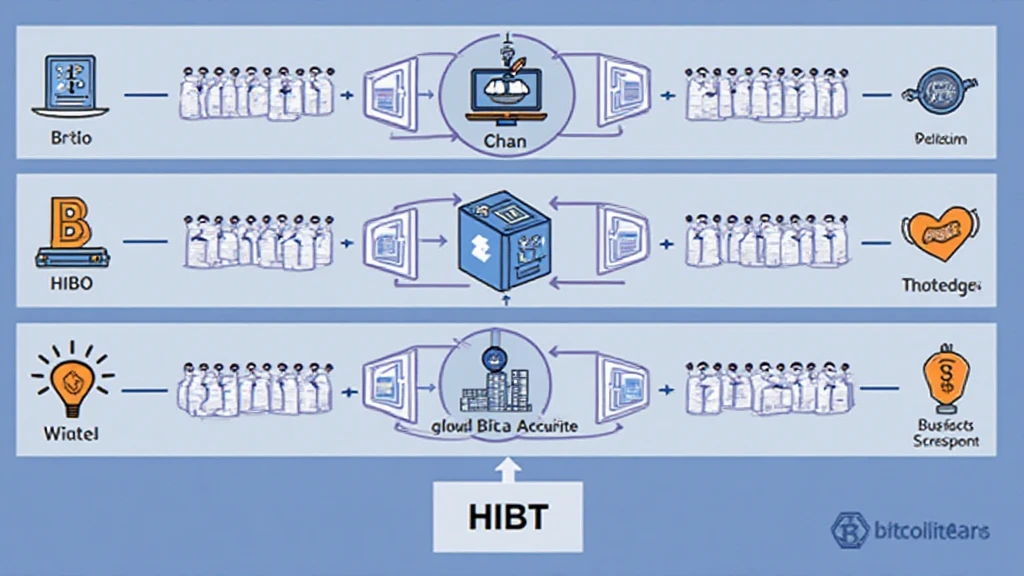

According to Chainalysis 2025 data, a staggering 68% of liquidity pools suffer from limited interoperability, stunting the growth of decentralized finance (DeFi) options across platforms. Today, we delve into the vital relationship between Bitcoin liquidity and the HIBT platform, while addressing pressing concerns surrounding cross-chain interoperability and the application of zero-knowledge proofs.

1. What is the current state of Bitcoin liquidity?

If you think of liquidity like a marketplace bustling with buyers and sellers, then Bitcoin liquidity is akin to the number of fruits on display. The more fruits (or Bitcoin) available, the easier it is to trade them without affecting prices. But did you know that the liquidity situation can vary greatly across different platforms? For instance, while HIBT aims for enhanced liquidity, many other platforms still struggle to attract enough users and capital.

2. How does the HIBT platform tackle cross-chain interoperability?

You might have encountered a situation where you want to exchange apples for oranges, but there’s no stall that does that. This is similar to cross-chain interoperability—various blockchain systems don’t communicate well with each other. HIBT has developed a solution that allows users to perform seamless transactions across different chains, ensuring better liquidity and minimizing friction in trades.

3. The role of zero-knowledge proofs in enhancing security

Imagine you’re in a crowded market and need to prove you have the money to buy your fruits without revealing how much you have. This is the magic behind zero-knowledge proofs (ZKPs). By implementing ZKPs, the HIBT platform ensures transactions remain private while still proving authenticity, which can greatly enhance user trust and liquidity.

4. What are the risks involved with blockchain liquidity?

Every marketplace has risks; there’s always a chance of fruit going bad, right? In the context of Bitcoin liquidity, risks include market volatility and potential exploits. Experts advise conducting thorough research prior to trading. Using tools such as Ledger Nano X can significantly lower the risk of private key exposure by over 70%.

In summary, understanding Bitcoin liquidity on the HIBT platform reveals critical insights into the evolving landscape of DeFi and cross-chain solutions. For detailed information and further analysis, download our comprehensive toolkit now!

For further details, check our cross-chain security white paper and feel free to explore other resources on HIBT.

Disclaimer: This article does not constitute investment advice. Consult local regulatory bodies (such as MAS/SEC) before any trading actions.