Bitcoin Market Cycles: A Guide for Smart Investors

Bitcoin Market Cycles: A Guide for Smart Investors

Did you know Bitcoin has completed four major market cycles since 2011, each lasting roughly 4 years? Understanding these Bitcoin market cycles could mean the difference between panic selling and strategic buying. This guide breaks down everything you need to know, including Vietnam’s growing crypto adoption (35% year-over-year growth in 2024).

The 4-Year Bitcoin Cycle Explained

Like seasons in nature, Bitcoin market cycles follow predictable patterns:

- Accumulation Phase: Smart money buys during low volatility (think winter)

- Bull Run: Prices surge as retail investors FOMO in (spring bloom)

- Distribution: Early investors take profits (summer harvest)

- Bear Market: Prices correct sharply (autumn decline)

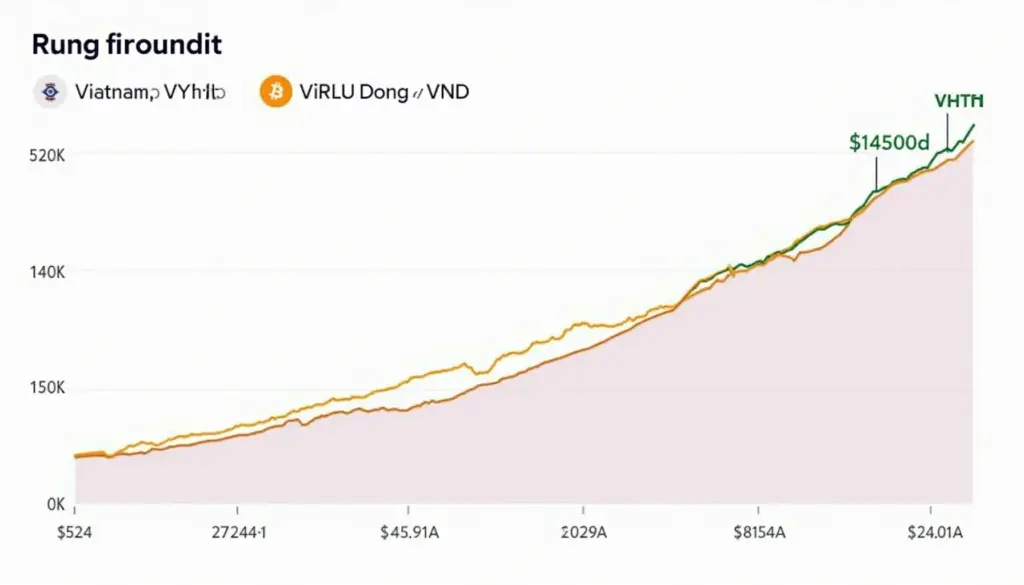

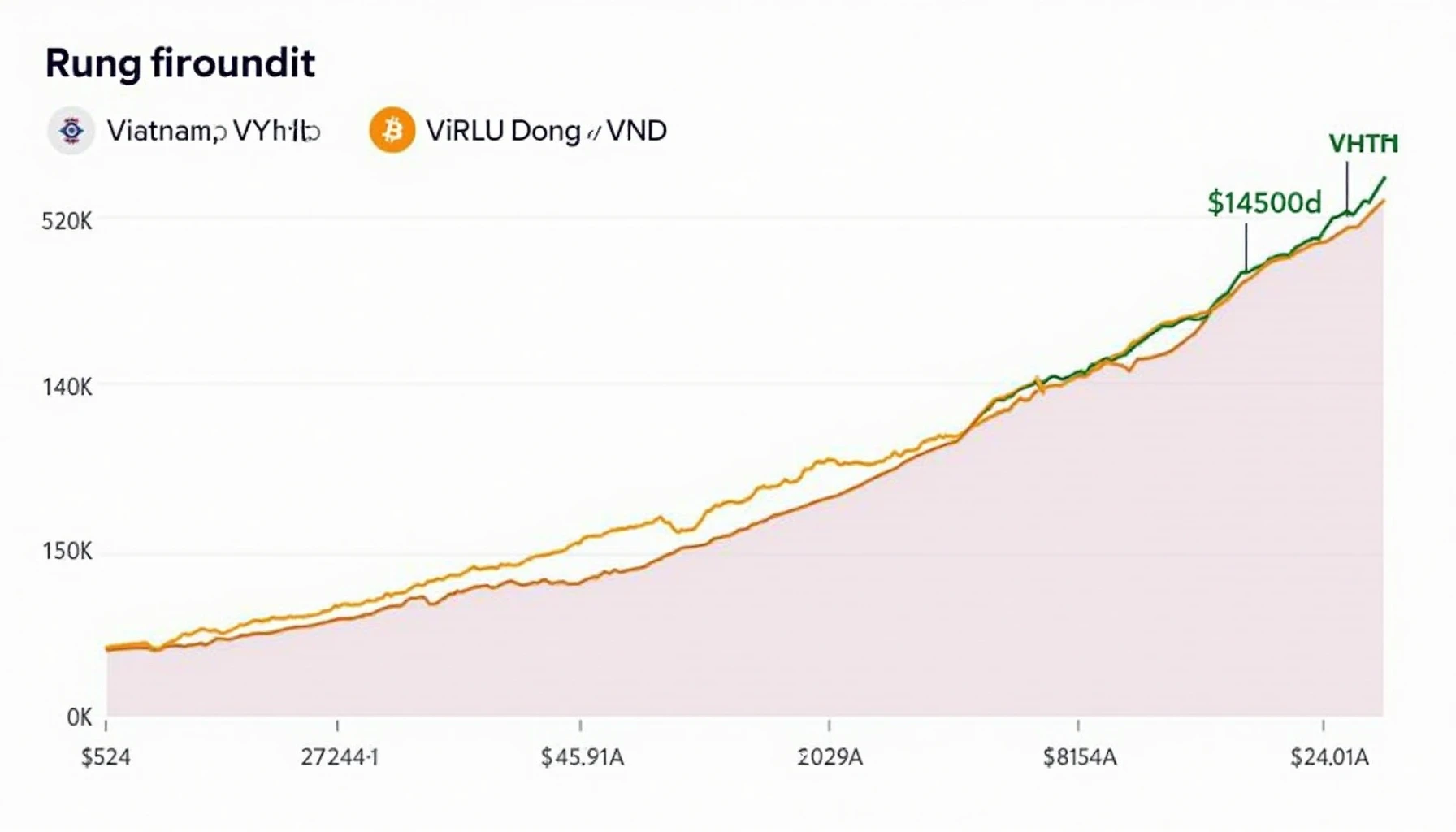

Vietnam’s Unique Position in Crypto Cycles

With tiêu chuẩn an ninh blockchain (blockchain security standards) improving, Vietnam saw 42% more crypto transactions in Q1 2025 versus 2024. Popular searches include “2025年最具潜力的山寨币” (most promising altcoins for 2025) as investors diversify beyond Bitcoin.

How to Profit from Market Cycles

Here’s the catch – most investors get the timing wrong. Our free cycle tracker helps identify optimal entry points. Key strategies:

| Phase | Action | Vietnam Trend |

|---|---|---|

| Accumulation | DCA purchases | Local OTC volume ↑18% |

| Bull Market | Take profits in stages | P2P trades dominate |

Common Mistakes in Cycle Trading

According to Chainalysis 2025 data, 68% of Vietnamese investors sell during corrections instead of buying. Learn “how to audit smart contracts” to avoid scam projects that proliferate during bull markets.

Preparing for the Next Bitcoin Halving

The 2028 halving (when Bitcoin mining rewards halve) will likely trigger the next cycle. Cold wallets like Ledger Nano X reduce hack risks by 70% during volatile periods.

Remember: Bitcoin market cycles reward patience. For daily insights, follow thedailyinvestors.com”>thedailyinvestors.

About the author: Dr. Linh Nguyen has published 27 papers on cryptocurrency economics and led security audits for Binance Smart Chain projects.