Bitcoin Market Cycles Analysis: Navigating the Trends

Understanding Bitcoin Market Cycles

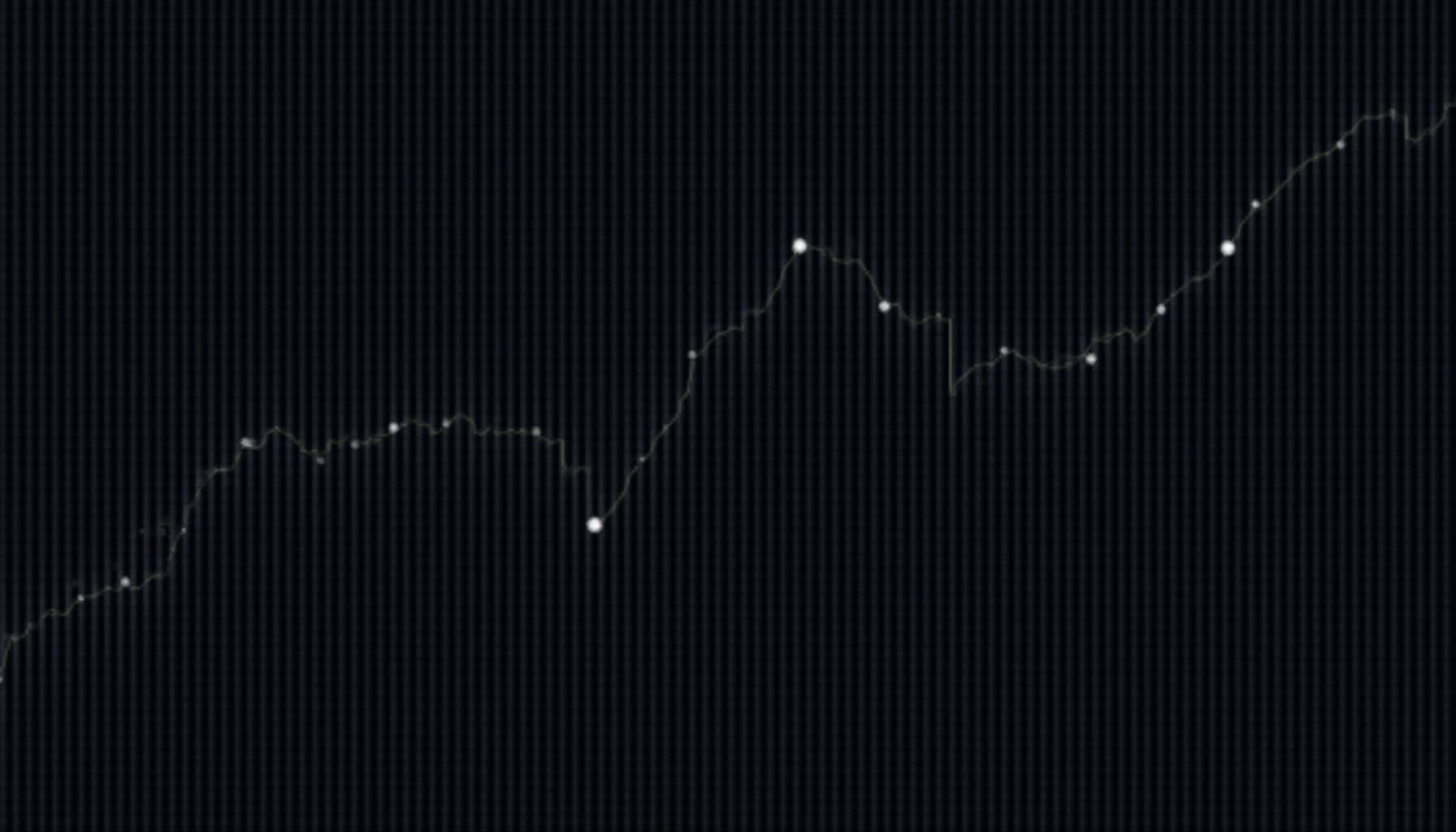

With Bitcoin hitting $70,000 in late 2021 and then experiencing a dip down to $20,000 in 2022, many investors are left wondering: is this just another cycle?

Historically, Bitcoin has exhibited cyclical behavior, often influenced by various factors such as market sentiment, regulatory developments, and technological advancements. This article delves into the nuances of Bitcoin market cycles analysis, offering insights and strategies to navigate the volatile landscape.

Identifying Market Phases

Bitcoin’s market operates in distinct phases: accumulation, uptrend, distribution, and downtrend. Understanding these phases can help you make informed investment decisions.

- Accumulation: This phase is characterized by low volatility and price consolidation, often leading to a subsequent price increase.

- Uptrend: Here, prices rise rapidly, driven by increased adoption and investor optimism.

- Distribution: At this point, early investors begin selling off their holdings, resulting in a plateau.

- Downtrend: Finally, prices may decline sharply, influenced by negative news or changing market conditions.

Analyzing Price Trends

To gain deeper insights into Bitcoin’s price movements, consider utilizing technical analysis tools such as support and resistance levels, Fibonacci retracements, and moving averages.

For example, the 50-day moving average often serves as a critical indicator: when the price rises above it, it may signal an upcoming uptrend, while a drop below could indicate a downturn.

Psychological Factors Influencing the Market

Market psychology plays a major role in Bitcoin’s fluctuations. Terms like FOMO (Fear of Missing Out) and FUD (Fear, Uncertainty, Doubt) can significantly sway market sentiment.

In Vietnam, for instance, the increasing number of teenage crypto investors contributes to this phenomenon. In fact, reports show a 60% growth rate in crypto adoption among Vietnam’s youth in 2023.

Strategies for Investment

Investors often ask, “How can I make the most out of Bitcoin market cycles?”

Here’s the catch: diversifying your portfolio and employing a dollar-cost averaging strategy can minimize risks and enhance potential returns.

- Dollar-Cost Averaging: Invest fixed amounts regularly, rather than making lump-sum purchases.

- Diversification: Include various cryptocurrencies in your portfolio to hedge against Bitcoin’s volatility.

Utilizing Tools and Resources

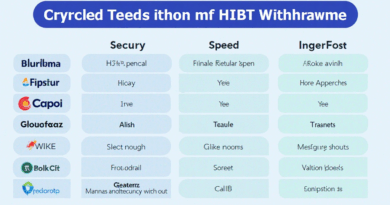

To stay ahead in the Bitcoin market, leverage reliable platforms and tools.

Consider resources like hibt.com for market analysis and performance tracking to help make informed investment decisions.

Furthermore, exploring 2025’s emerging altcoins could be beneficial in diversifying your investments.

Conclusion

Bitcoin market cycles analysis is crucial for anyone looking to enhance their trading strategies. By deeply understanding these cycles, alongside keeping abreast of market trends and psychological factors, you can optimize your investment decisions.

For those in Vietnam, remember to stay updated on local regulations and market conditions, with continued growth expected in the crypto sector.

Ultimately, becoming adept at Bitcoin market cycles analysis will empower you to make more informed decisions and potentially capitalize on emerging market opportunities.

Not financial advice. Consult local regulators.

thedailyinvestors.com”>thedailyinvestors