Understanding Bitcoin Mining Difficulty Chart

Introduction: The Importance of Bitcoin Mining Difficulty

In 2024, the cryptocurrency landscape saw a staggering $4.1 billion lost to decentralized finance hacks. This statistic underlines the importance of understanding blockchain security mechanisms, including Bitcoin mining. But how does mining difficulty play into this? Today, we dissect the Bitcoin mining difficulty chart and its relevance in the crypto world.

What is Bitcoin Mining Difficulty?

Bitcoin mining difficulty refers to how hard it is to find a new block in the blockchain. The difficulty level adjusts every 2,016 blocks, ensuring that a new block is added approximately every 10 minutes. This algorithm is in place to maintain the **supply rate** of Bitcoin steady.

The Logic Behind Difficulty Adjustment

Imagine a bank vault securing precious assets. The harder it is to break in (or mine Bitcoins), the more secure your assets are. As more miners join the network, the difficulty increases, ensuring the security and integrity of Bitcoin.

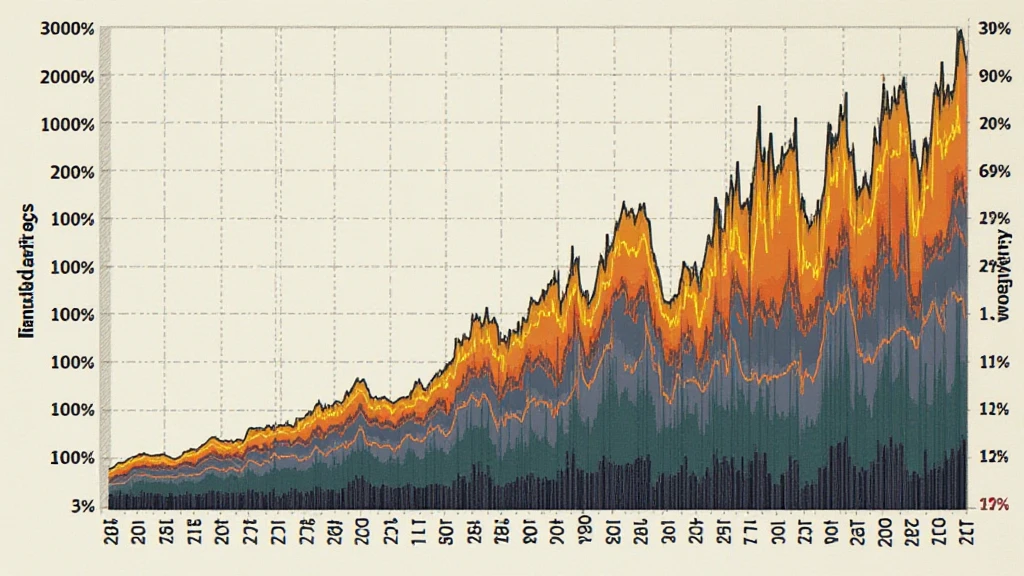

Understanding the Bitcoin Mining Difficulty Chart

The Bitcoin mining difficulty chart illustrates the changes in mining difficulty over time. Here’s a snapshot of key metrics:

| Date | Difficulty Level | Blocks Mined |

|---|---|---|

| January 2024 | 25.00 T | 836 |

| February 2024 | 26.50 T | 890 |

| March 2024 | 27.75 T | 920 |

This data emphasizes a rising trend in mining difficulty, primarily driven by the increasing number of miners and improvements in hardware technology.

The Trends in Vietnam’s Crypto Market

According to local data, Vietnam has witnessed a 30% growth rate in cryptocurrency users in the past year. Such rapid adoption amplifies the competition among miners and subsequently impacts the Bitcoin mining difficulty chart.

Practical Implications for Miners

For miners, understanding the difficulty chart is vital for operational efficiency. Knowing when to invest in better hardware or adjust mining strategies can significantly improve profitability.

Using Tools to Navigate Difficulty Charts

Investing in practical tools like the ASIC Miner can optimize mining operations. Users seeking to mitigate losses should also consult resources such as hibt.com, which provide insights into effective mining strategies.

Conclusion: The Future of Mining Difficulty

The Bitcoin mining difficulty chart will continue to evolve, influenced by user growth and technological advancements. For miners in Vietnam and beyond, staying updated with these trends is essential for success in the burgeoning crypto landscape.

Remember, not financial advice; always consult local regulations before investing.