Understanding the Bitcoin Mining Difficulty Chart for 2025 Trends

Understanding the Bitcoin Mining Difficulty Chart for 2025 Trends

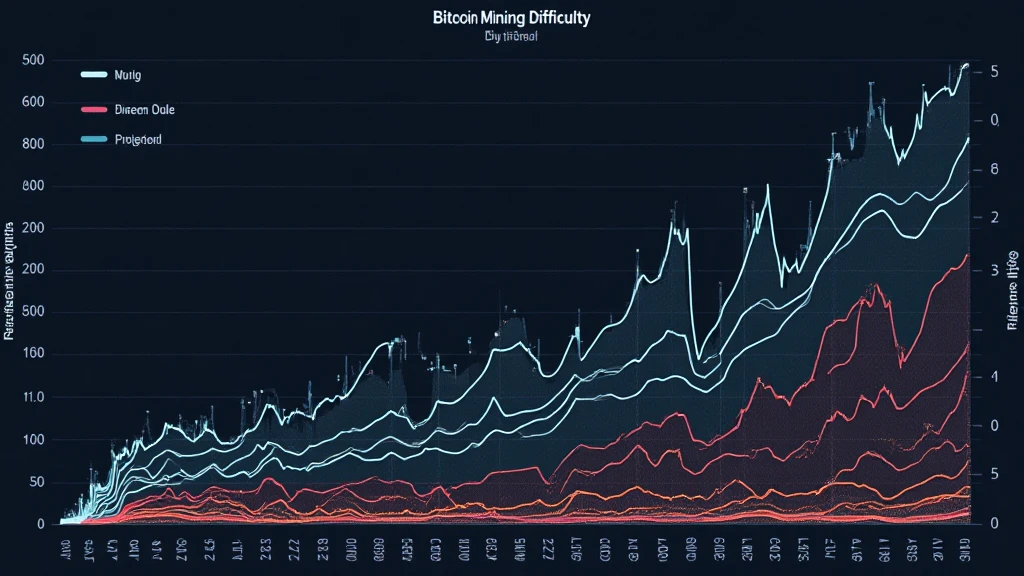

According to Chainanalysis 2025 data, miners face increasing challenges in profitability due to fluctuating Bitcoin mining difficulties. In fact, 73% of miners report declining returns amid rising operational costs. Today, we’ll delve into the Bitcoin mining difficulty chart to understand its implications on the blockchain ecosystem.

What Does the Bitcoin Mining Difficulty Chart Indicate?

The Bitcoin mining difficulty chart serves as a key indicator of how hard it is to mine new Bitcoin. Think of it like a busy market—when there are more customers, vendors need to raise their prices to keep up. Similarly, as more miners join the network, the difficulty increases, requiring more computational power and energy to solve complex mathematical puzzles.

How Are Miners Adapting to Difficulty Changes?

Miners are employing various strategies to cope with the rising difficulty. For instance, some are upgrading to more efficient mining rigs, while others are relocating their operations to regions with lower electricity costs—like Dubai, which has a growing interest in crypto-friendly tax environments. Just like a grocery shopkeeper would change suppliers for better quality or pricing, miners are seeking optimal conditions for profitable operations.

What Are the Impacts on Bitcoin’s Price?

As mining difficulty changes, Bitcoin’s price can be influenced significantly. When mining becomes less profitable, some miners may exit the market, leading to lower supply, which ironically can drive prices up. Picture a fruit market: if several vendors stop selling apples, the remaining ones can charge more due to scarcity. This relationship can create a cyclical effect on Bitcoin’s market value.

The Role of Regulations in Mining Activities

Emerging regulations, particularly regarding environmental impacts, may shape future mining practices. For example, countries with stringent energy regulations might deter inefficient mining operations. In essence, you can think about it like a parking regulation; if it costs too much to park, many drivers may look for alternative transportation methods. As miners adapt to these regulations, the Bitcoin mining difficulty chart will continue to evolve.

In conclusion, understanding the Bitcoin mining difficulty chart is crucial for anyone interested in the cryptocurrency landscape. To keep up with the latest trends, download our innovative toolkit.

View our Bitcoin mining whitepaper and learn more about how miners can stay ahead in this volatile market.

Risk Disclosure: This article does not constitute investment advice. Please consult local regulatory authorities before making any investment decisions.

Stay informed with the latest insights from thedailyinvestors.