Bitcoin Mining Difficulty Trends: What You Need to Know

Understanding Bitcoin Mining Difficulty

As cryptocurrency gains popularity, understanding the Bitcoin mining difficulty trends becomes imperative for both novice and seasoned investors. In 2024, the total amount lost to hacks in DeFi platforms reached $4.1 billion, emphasizing the need for enhanced security practices in crypto investments.

The Dynamics of Bitcoin Mining Difficulty

Bitcoin mining difficulty adjusts approximately every two weeks, reflecting changes in the network hash rate. This mechanism ensures that new blocks are mined at a stable rate, typically every 10 minutes. When more miners join the network, the difficulty increases. Conversely, if miners exit, the difficulty decreases. This fluctuation can significantly affect your returns.

Why Does Mining Difficulty Matter?

- Impact on Profitability: Higher difficulty means reduced profit margins for miners, while lower difficulty offers more opportunities.

- Investment Strategies: Understanding these trends can guide your investment decisions. For instance, aligning your mining operations during low difficulty periods can be more profitable.

- Market Sentiment: Fluctuating difficulty levels can also influence market psychology, impacting Bitcoin’s price in Vietnam and beyond.

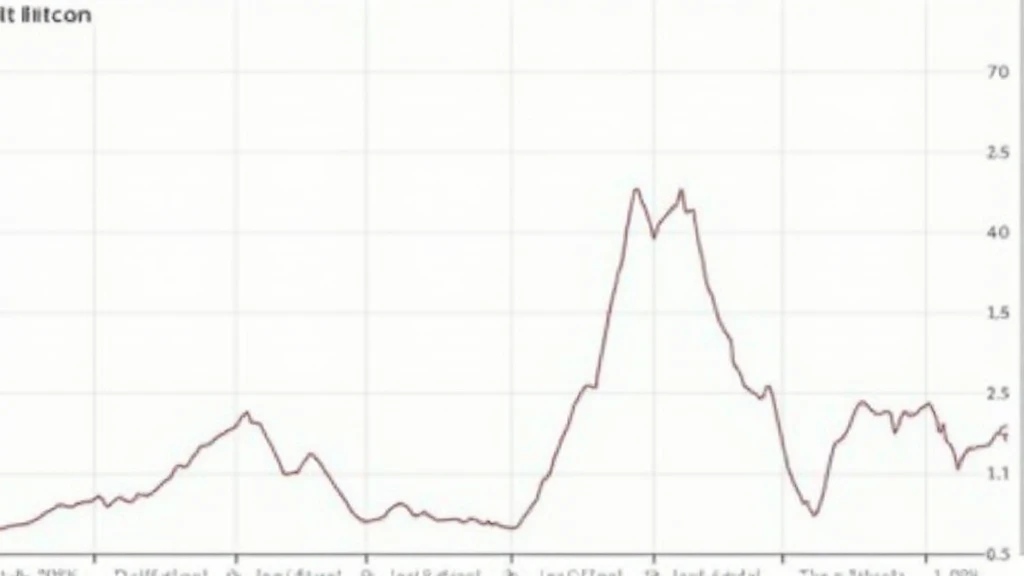

Bitcoin Difficulty Trends: Data Insights

Recent data shows a notable trend in Bitcoin mining difficulty throughout 2025. The average mining difficulty has increased by 20% since Q1 2024, as more miners enter the space.

| Time Period | Difficulty Level | Change (%) |

|---|---|---|

| Q1 2025 | 18 trillion | – |

| Q2 2025 | 21.6 trillion | 20% |

Data Source: Blockchain.com

Local Market Trends: Vietnam’s Crypto Landscape

Vietnam’s blockchain community has seen substantial growth, with an estimated 7 million active cryptocurrency users in 2024, up 35% from the previous year. This surge highlights the importance of staying informed about Bitcoin mining difficulty trends, particularly for local investors seeking to maximize returns.

Challenges of High Difficulty

High mining difficulty can deter small-scale miners in Vietnam. Miners might consider joining mining pools to collaborate and share resources, enhancing their chances to remain profitable.

Conclusion: Staying Ahead in Bitcoin Mining

In closing, understanding Bitcoin mining difficulty trends can significantly influence your financial decisions in the cryptocurrency market. By keeping an eye on these fluctuations, you position yourself for better outcomes in your investment strategy.

As you navigate the complexities of Bitcoin mining and investment, consider tools like Ledger Nano X for enhanced security against potential hacks.

thedailyinvestors is your go-to source for understandable and reliable cryptocurrency insights.