Understanding Bitcoin Mining Pool Fees

Introduction

As the crypto landscape grows, Bitcoin mining continues to attract both seasoned investors and newcomers. However, with the vast amount of $4.1 billion lost to DeFi hacks in 2024, everyone needs to be careful with their investments. One essential aspect of Bitcoin mining is understanding Bitcoin mining pool fees. If you’re considering joining a mining pool, it’s vital to know how these fees affect your overall earnings.

What are Mining Pools?

Mining pools are groups of miners who share their computational resources. By pooling their efforts, they can improve their chances of successfully mining blocks and sharing the rewards. This collaboration makes it easier for smaller miners to gain profits without needing a massive investment in hardware.

How Do Mining Pool Fees Work?

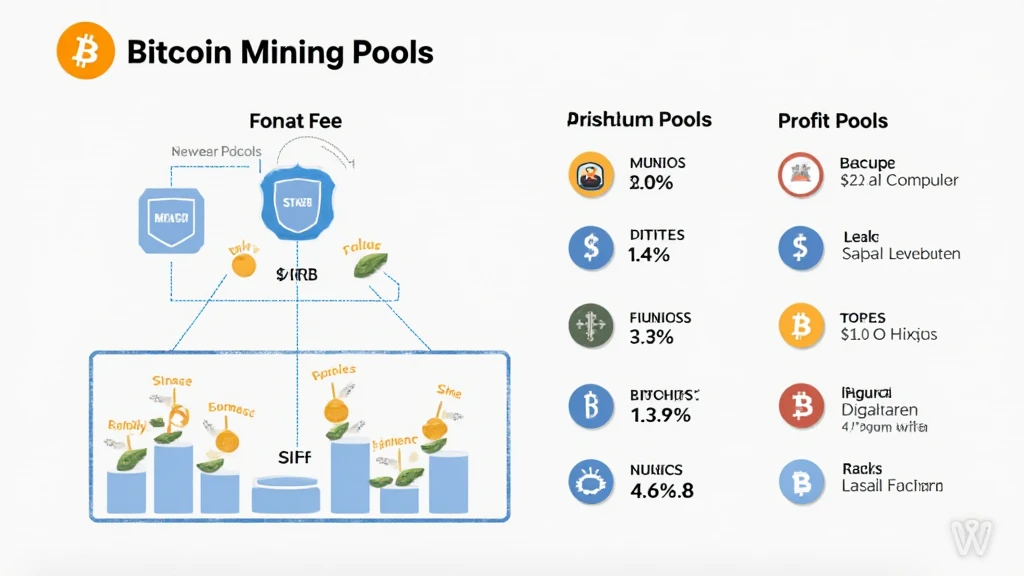

Every mining pool typically charges a fee for their services. These fees can vary widely between different pools and are usually a percentage of the rewards earned. Understanding these fees is essential, as they directly impact your profit margins.

- **Fee Structure**: Most pools charge anywhere between 1% to 3% of your earnings.

- **Payout Systems**: Different pools use varied payout systems, such as Pay Per Share (PPS) or Pay Per Last N Shares (PPLNS).

Comparing Bitcoin Mining Pool Costs

When selecting a mining pool, it’s crucial to compare their fees. For example, a pool with a lower fee percentage may seem attractive, but hidden costs or higher minimum payout thresholds can diminish your profits. Research various pools, checking their reputation and historical performance.

Impact of Fees on Earnings

Here’s the catch: the higher the fees, the lower your overall earnings. Many miners who do not account for these fees can be surprised when they receive their payouts. Here are some statistics that underline this point:

- According to a recent study, miners can lose up to **10%** of their potential profits to pool fees if they choose poorly.

- In Vietnam, the number of crypto users increased by **300%** in 2023. This suggests a growing market that may not fully understand the implications of mining fees.

Tips for Minimizing Pool Fees

So, how can you maximize your earnings? Here are some practical tips:

- **Select Wisely**: Opt for a pool with a reasonable fee structure that matches your mining goals.

- **Evaluate Performance**: Look for pools with a history of stable and fair payouts.

- **Switch Pools**: If your pool’s fees become too high, don’t hesitate to switch to a more favorable option.

Conclusion

Understanding Bitcoin mining pool fees is crucial for maximizing your earnings as a miner. By carefully selecting your mining pool and being aware of the costs involved, you can make decisions that align with your financial goals. In the rapidly evolving crypto landscape, proper knowledge can be your best ally. As Vietnam continues to see impressive growth in its crypto user base, the need for understanding blockchain security standards (“tiêu chuẩn an ninh blockchain”) is paramount. For additional insights, check out our resources at hibt.com and stay ahead in your investment journey.