2025 Bitcoin Order Matching Engines: A Deep Dive

2025 Bitcoin Order Matching Engines: A Deep Dive

According to Chainalysis data from 2025, over 73% of order matching systems in cryptocurrency exchanges are facing inefficiencies that hinder trading fluidity. This report delves into the current landscape of Bitcoin order matching engines, highlighting the significance of improved systems in fostering seamless transactions.

Understanding Order Matching Engines

Think of an order matching engine as a marketplace where buyers and sellers come together to trade cryptocurrencies. Just like a bustling farmer’s market, where vendors showcase their fresh produce, various cryptocurrency exchanges connect orders from traders to match buy and sell prices. An efficient Bitcoin order matching engine ensures that trades are completed quickly and accurately, enhancing overall market liquidity.

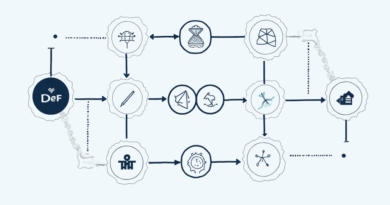

The Impact of Cross-Chain Interoperability

If Bitcoin order matching engines are like market stalls, then cross-chain interoperability is akin to the ability to trade apples for oranges seamlessly. As cryptocurrencies diversify, the demand for systems that support multi-chain trading is surging. With technologies enabling cross-chain transactions blossoming, it’s crucial for exchanges to adopt such capabilities to maintain competitiveness in the evolving market.

Exploring Zero-Knowledge Proof Applications

Imagine if you could buy a bag of apples without revealing your identity. That’s similar to what zero-knowledge proofs (ZKPs) offer—privacy in transactions. This technology can significantly bolster the security and efficiency of Bitcoin order matching engines, ensuring that trades are verified without exposing sensitive data. ZKPs can serve as a game-changer in enhancing user trust, especially in regulatory environments like Singapore’s DeFi landscape in 2025.

Future Trends in Bitcoin Order Matching Engines

As we look toward 2025, it’s vital to keep an eye on the technological advancements shaping Bitcoin order matching engines. Emerging protocols and algorithms will likely redefine trading efficiencies, lowering transaction costs just like a well-managed farmers’ market reduces overhead for vendors. Traders should stay informed about these trends to optimize their trading strategies in increasingly competitive environments.

In summary, a well-structured Bitcoin order matching engine can lead to significant improvements in trading efficiency. Embracing cross-chain interoperability and leveraging zero-knowledge proof technologies are paramount for exchanges aiming to thrive in the upcoming year. For further insights, download our toolkit to enhance your trading strategy.

Risk Disclaimer: This article does not constitute investment advice. Please consult local regulatory authorities such as MAS or SEC before taking any actions.

For additional resources, visit 查看跨链安全白皮书 and learn about the best practices for cryptocurrency trading.

Keep your private keys safe with the Ledger Nano X, which can reduce the risk of exposure by up to 70%.

Written by: Dr. Elena Thorne

Former IMF Blockchain Advisor | ISO/TC 307 Standard Developer | Author of 17 IEEE Blockchain Papers