2025 Bitcoin Position Trading Trends: What You Need to Know

2025 Bitcoin Position Trading Trends: What You Need to Know

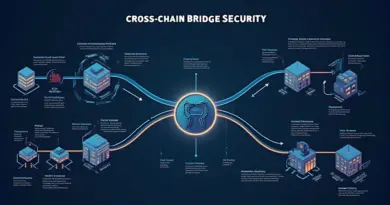

According to Chainalysis data from 2025, a staggering 73% of cryptocurrency platforms face significant weaknesses. This situation has amplified the importance of mitigating risks in Bitcoin position trading for investors around the globe.

1. What is Bitcoin Position Trading?

Think of Bitcoin position trading like a deep freezer at your local grocery store. Just as you can store your favorite food for months, position trading allows you to hold Bitcoin for a longer period, waiting for the value to increase without worrying about daily fluctuations.

2. How to Identify the Right Entry and Exit Points?

Imagine you’re buying apples during the harvest when prices are low. For Bitcoin position trading, you need to identify these ‘harvest’ moments through market analysis, trends, and indicators, ensuring you maximize your profit when it’s time to sell.

3. Managing Risks in Bitcoin Position Trading

Picture a seatbelt in your car—you buckle it to protect yourself in case of sudden stops. In Bitcoin position trading, utilizing risk management tools, such as stop-loss orders, ensures that you limit potential losses without overexposing your capital.

4. The Future of Bitcoin Position Trading: Automation and Technology

Have you seen those vending machines that give you change and a snack? Automated trading systems work similarly in Bitcoin position trading—operating 24/7 to buy and sell based on preset parameters, making it easier for you to trade without constantly monitoring the market.

In conclusion, understanding Bitcoin position trading is essential for navigating the volatile cryptocurrency landscape, especially as we look toward 2025. If you wish to dive deeper into risk management strategies or other trading tools, consider downloading our comprehensive toolkit.

For more information on cryptocurrency insights and strategies, visit hibt.com to explore related articles.

Risk Disclaimer: This article does not constitute investment advice. Always consult with local regulatory authorities (e.g., MAS/SEC) before making any financial decisions.

Increase your security against private key exposure with the Ledger Nano X, which can reduce risks by up to 70%.