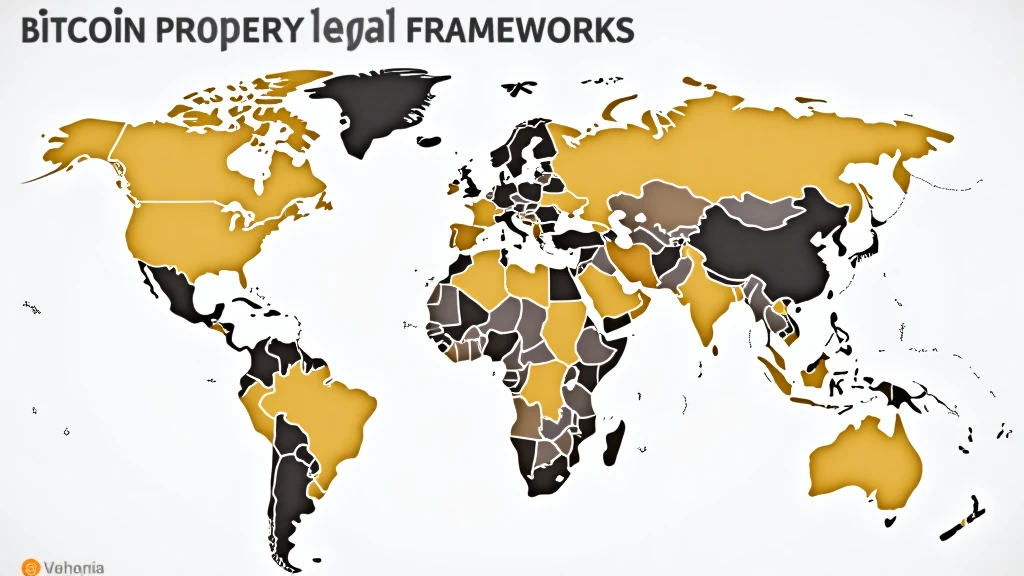

Bitcoin Property Legal Frameworks: Understanding the Landscape

Introduction

In 2024, the global cryptocurrency landscape witnessed losses exceeding $4.1 billion due to regulatory uncertainties and legal ambiguities. This raises an essential question: how do we navigate Bitcoin property legal frameworks? Understanding these frameworks is crucial for securing your digital investments. In this article, we provide insights into the current legal environments surrounding Bitcoin property, especially focusing on regions like Vietnam, where user adoption is skyrocketing.

What Are Bitcoin Property Legal Frameworks?

Bitcoin property legal frameworks refer to the laws and regulations that govern the ownership, transfer, and taxation of Bitcoin as a property asset. These frameworks differ significantly across jurisdictions, leading to various interpretations and applications.

- In the United States, Bitcoin is often treated as property subject to capital gains tax.

- Countries like Vietnam are developing their legal approaches amidst an exponential increase in cryptocurrency users.

The Importance of Regulatory Clarity

Imagine walking into a bank without knowing the rules; that’s similar to investing in Bitcoin without understanding its legal frameworks. Regulatory clarity ensures that investors can make informed decisions, cultivating a secure environment for all participants. For instance:

- Clear tax guidelines help in proper financial planning.

- Defined ownership laws provide a safeguard against theft and fraud.

Challenges in Implementation

Despite the growing focus on Bitcoin property legal frameworks, several challenges persist:

- Vague Definitions: Many jurisdictions lack precise definitions of cryptocurrency, causing inconsistencies.

- Rapid Technological Changes: The pace of innovation in blockchain technology can outstrip existing legal structures.

Case Study: Vietnam’s Growing Crypto Market

According to recent data, Vietnam has seen a dramatic 250% increase in cryptocurrency users since 2022. The Vietnamese government is actively exploring regulations to ensure that Bitcoin property rights are clearly articulated. This approach aims to address the needs of a rapidly growing user base while safeguarding consumer interests. Here’s how:

- Enhanced investor protections through policy frameworks.

- Promotion of clear guidelines on the taxation of crypto holdings.

Conclusion

Navigating Bitcoin property legal frameworks can feel daunting, but understanding the underlying principles is vital for securing your digital assets. With the rise in popularity of cryptocurrencies like Bitcoin, countries are beginning to develop more robust legal frameworks. Stay informed and consult local regulations regularly to ensure compliance. Remember, as the crypto market continues to evolve, so will its legal landscape. For further insights and tools to safeguard your investments, check out Hibt’s resources for best practices.