Understanding Bitcoin to KRW Trading Volume Trends in 2025

Understanding Bitcoin to KRW Trading Volume Trends in 2025

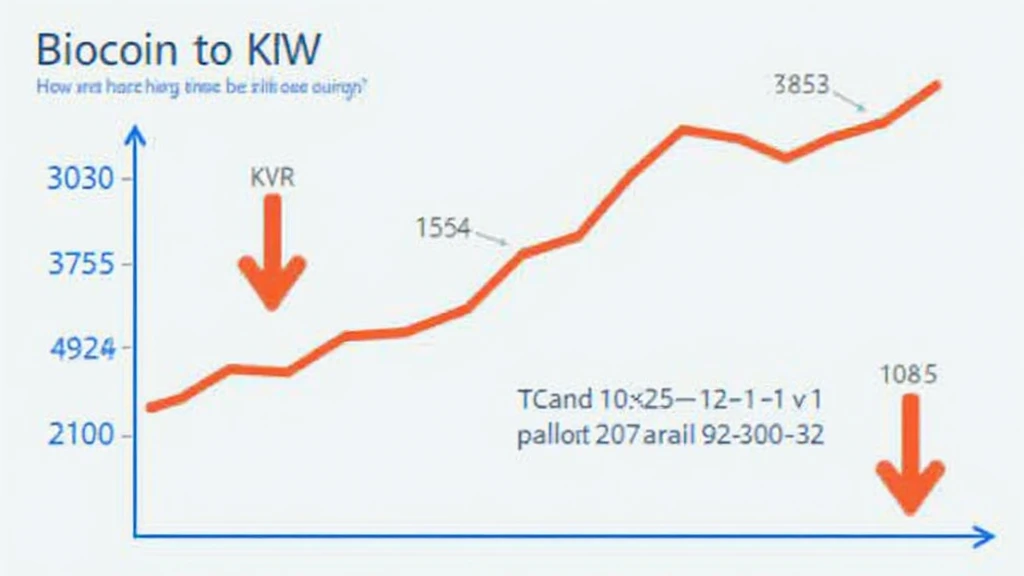

According to Chainalysis 2025 data, nearly 60% of Bitcoin transactions lack clarity, creating confusion for traders and investors alike. In the rapidly changing world of cryptocurrencies, keeping track of Bitcoin to KRW trading volume is vital for understanding market dynamics.

What Influences the Bitcoin to KRW Trading Volume?

Just like how the price of fruits can fluctuate based on season and availability, the trading volume of Bitcoin to KRW also changes due to various factors. Economic policies, regional adoption rates, and technological advancements can all impact trading volume. For example, when the government in South Korea announces favorable regulations, it often leads to an uptick in trading volume.

How Do Traders Analyze Bitcoin to KRW Transactions?

Think of analyzing Bitcoin to KRW trading volume like selecting the freshest vegetables at a market. Traders study transaction patterns, utilizing tools like CoinGecko and other analytics platforms. By comprehending these patterns, they can make informed decisions, just as you would choose only the ripest tomatoes!

Are there Risks in Bitcoin to KRW Trading?

As in any marketplace, risks are involved. The Bitcoin to KRW trading volume can be quite volatile, similar to how the price of avocados can spike unexpectedly. It’s essential for traders to be aware of the local regulations and market changes to ensure safer transactions and avoid losses.

How Can Localized Tools Help in Bitcoin to KRW Trading?

Localized tools, such as those specific to the South Korean market, provide traders with crucial insights. Imagine having a special recipe book that features local dishes from your city—it just makes cooking more authentic! These tools can enhance trading experiences and provide up-to-date information about market trends.

In conclusion, understanding Bitcoin to KRW trading volume can greatly enhance your trading strategies. For further information and tools, be sure to download our toolkit and optimize your trading approach.

Disclaimer: This article does not constitute investment advice. Always consult your local regulatory agency before making any investment decisions.

For additional resources and insights into cryptocurrency trends, visit hibt.com for our in-depth blockchain security white papers.