Bitcoin Transaction Speed Optimization: Navigating the Future of Crypto Transfers

Bitcoin Transaction Speed Optimization: Navigating the Future of Crypto Transfers

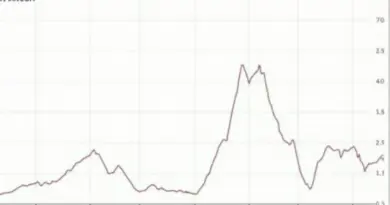

According to Chainalysis data from 2025, a staggering 73% of Bitcoin transactions face latency issues due to network congestion. This poses serious challenges for users expecting swift transactions in an increasingly fast-paced financial landscape. In this article, we will explore Bitcoin transaction speed optimization and its implications for the crypto market, as well as potential solutions like cross-chain interoperability and zero-knowledge proof applications.

Understanding Bitcoin Transaction Delays

Imagine a crowded marketplace where vendors are constantly exchanging goods. When too many people want to buy at once, the waiting lines become unbearably long. This is akin to the Bitcoin network today, where transaction requests can pile up, leading to delays. The primary factor causing these delays is the limited block size, capped at 1MB, which restricts the number of transactions processed at any given time.

Cross-Chain Interoperability: A Game Changer

So, how can we solve the crowding issue? Enter cross-chain interoperability, which functions much like currency exchange booths at an airport. When you want to swap dollars for euros, you visit a booth that facilitates the exchange. Similarly, cross-chain solutions allow transactions across different blockchain networks, effectively alleviating congestion on the Bitcoin network. As we approach 2025, these solutions are predicted to significantly lower transaction times and costs.

Zero-Knowledge Proof Applications: Enhancing Privacy

Now, let’s consider zero-knowledge proofs. This technology allows one party to prove to another that something is true without revealing any additional information. Think of it like sharing a secret code with a friend to confirm you both belong to the same club, without needing to disclose your membership details. By implementing zero-knowledge proofs, Bitcoin could enhance security without sacrificing speed, providing efficient transaction processing while keeping users anonymous.

The Impact of Energy Consumption from PoS Mechanisms

Switching gears, let’s compare the energy consumption of Proof of Stake (PoS) mechanisms with Bitcoin’s Proof of Work (PoW). PoW requires considerable energy for mining, causing environmental concerns. Conversely, PoS, which relies on validators, offers a greener alternative. As we step into 2025, understanding these mechanisms will be crucial for investors keen on advocating sustainable practices in the crypto world.

Conclusion

In conclusion, Bitcoin transaction speed optimization is vital for the crypto industry’s future. As technologies like cross-chain interoperability and zero-knowledge proofs emerge, the landscape will undoubtedly shift towards more efficient systems. For those interested in navigating and optimizing their cryptocurrency transactions, we recommend downloading our comprehensive toolkit on improving Bitcoin transactions.

Read more about cross-chain security solutions here and improve your investment strategies.

Risk Warning: This article does not constitute investment advice; consult your local regulatory authority (e.g., MAS/SEC) before making any operation. Protect your cryptocurrencies with tools like Ledger Nano X, which can reduce the risk of key exposure by up to 70%.

– The Daily Investors