How Do Bonds Work? A Deep Dive into Fixed-Income Investing

Bonds are often hailed as the cornerstone of conservative investment strategies, yet many investors remain unclear about their mechanics and potential benefits. Understanding how bonds function is crucial for anyone looking to diversify their portfolio, generate steady income, or mitigate risk. This article delves into the intricacies of bonds, addressing common questions and providing insights backed by expert analysis and data.

What Is a Bond?

At its core, a bond is a debt instrument. When you purchase a bond, you’re essentially lending money to an issuer—be it a government, municipality, or corporation. In return, the issuer agrees to pay you interest at regular intervals and repay the principal amount (the face value) upon maturity .

The interest paid is known as the “coupon,” and the bond’s face value is typically $1,000. For instance, a 5% annual coupon on a $1,000 bond would yield $50 per year, often distributed semiannually.

The Bond Lifecycle

- Issuance: Bonds are issued in the primary market, where investors purchase them directly from the issuer.

- Coupon Payments: Over the life of the bond, the issuer makes periodic interest payments to bondholders.

- Maturity: Upon reaching the maturity date, the issuer repays the bond’s face value to the holder.

Types of Bonds

- Government Bonds: Issued by national governments, these are considered low-risk. U.S. Treasury bonds, for example, are backed by the full faith and credit of the U.S. government.

- Municipal Bonds: Issued by states or local governments, often offering tax advantages.

- Corporate Bonds: Issued by companies to fund operations or expansion. These carry higher risk but offer higher yields.

- Convertible Bonds: Corporate bonds that can be converted into a predetermined number of the company’s shares.

Understanding Bond Prices and Yields

Bond prices and yields share an inverse relationship. When interest rates rise, existing bond prices typically fall, and vice versa. This is because new bonds are issued with higher yields, making existing bonds with lower yields less attractive unless their prices decrease .

For example, if you hold a bond with a 3% coupon and market rates rise to 4%, your bond’s price will likely drop to align its yield with the new market rate.

Risks Associated with Bonds

While bonds are generally safer than stocks, they come with their own set of risks:

- Interest Rate Risk: The risk that changes in interest rates will affect bond prices.

- Credit Risk: The possibility that the issuer may default on payments.

- Inflation Risk: The risk that inflation will erode the purchasing power of future interest payments.

- Liquidity Risk: The risk that you may not be able to sell the bond before maturity without incurring a loss.

The Role of Bonds in an Investment Portfolio

Bonds play a vital role in portfolio diversification. They often behave differently from stocks, providing stability during market volatility. For instance, during periods of economic downturn, bonds may outperform equities, offering a buffer against stock market declines .

Current Trends in the Bond Market

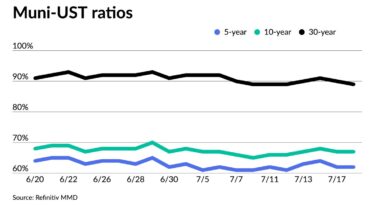

As of 2025, bond yields have become more attractive. For example, long-term U.S. Treasury bonds are offering yields comparable to 30-year Treasury yields, appealing to income-focused investors. Additionally, municipal bonds are seeing increased issuance, providing opportunities for tax-free income .

Conclusion

Understanding how bonds work is essential for making informed investment decisions. They offer a reliable income stream, diversification benefits, and can serve as a hedge against economic downturns. By grasping the fundamentals of bond investing, you can better navigate the complexities of the financial markets and build a more resilient investment portfolio.

Author: Jordan Lee, CFA

Jordan Lee is a Chartered Financial Analyst with over 15 years of experience in fixed-income markets. He has worked with institutional investors, providing insights into bond market trends and strategies. Jordan specializes in portfolio management and has contributed to various financial publications on topics related to bond investing.