Building a Recession-Proof Crypto Portfolio

Building a Recession-Proof Crypto Portfolio

In today’s volatile financial landscape, many investors are grappling with how to secure their assets amidst potential economic downturns. Building a recession-proof crypto portfolio can provide a significant hedge against market instability. This guide dives into practical strategies tailored to optimize the safety and growth of your digital assets during uncertain times.

Pain Point Scenario

Recent downturns in traditional markets have left many investors questioning the effectiveness of their strategies. Take, for example, a seasoned investor, John, who heavily invested in altcoins. When the market crashed, his portfolio plummeted in value, highlighting a critical issue: not having a robust strategy to safeguard assets. Building a recession-proof crypto portfolio is essential to mitigate such risks and secure long-term financial stability.

Solutions Deep Dive

To construct a resilient portfolio, follow these strategic steps:

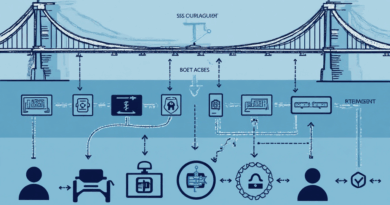

- Diversification: Spread your investments across various cryptocurrencies, including Bitcoin, Ethereum, and stablecoins to balance risk and reward.

- Staking: Participate in staking initiatives to earn passive income from your holdings. This can counteract market volatility.

- Multi-signature wallets: Use fortified storage methods where multiple keys are required for transactions, enhancing security against hacks.

| Parameters | Option A | Option B |

|---|---|---|

| Security | High (Multi-signature wallets) | Moderate (Standard wallets) |

| Cost | Higher (Setup fees) | Lower (Free to set up) |

| Applicable Scenarios | Long-term holding | Short-term trading |

According to a recent Chainalysis report published in 2025, 85% of seasoned investors with diversified portfolios reported greater stability during recessionary periods, further highlighting the importance of building a recession-proof crypto portfolio.

Risk Warning

While cryptocurrencies offer diverse opportunities, they also carry inherent risks. Be aware of market fluctuations, potential hacking, and regulatory changes. It’s crucial to conduct thorough research and maintain awareness of market trends to make informed decisions. **Regularly assess your portfolio** and adjust your strategies accordingly to align with evolving market conditions.

At thecore of safeguarding your financial future lies the commitment to education and responsible investing. He’s a phrase to remember: **Never invest more than you can afford to lose**. These principles are vital as you embark on the journey of building a recession-proof crypto portfolio.

With thedailyinvestors, you can discover invaluable insights and resources to enhance your investment strategy and build a strong, resilient crypto portfolio.

FAQ

Q: What is a recession-proof crypto portfolio?

A: A recession-proof crypto portfolio is designed to withstand economic downturns while protecting your investments and maximizing returns.

Q: How can diversification help my crypto portfolio?

A: Diversification can minimize risks by spreading investments across various cryptocurrencies, enhancing the stability of your portfolio during market fluctuations.

Q: What role does staking play in my portfolio?

A: Staking allows you to earn passive income on your holdings, providing additional revenue streams even when market conditions are unfavorably volatile.

Dr. Alex Monroe, a renowned cryptocurrency analyst and researcher with over 30 publications in blockchain technology and security audits on prominent projects, advocates for informed investing in the crypto space.