Chart Patterns Every Trader Should Know

Chart Patterns Every Trader Should Know

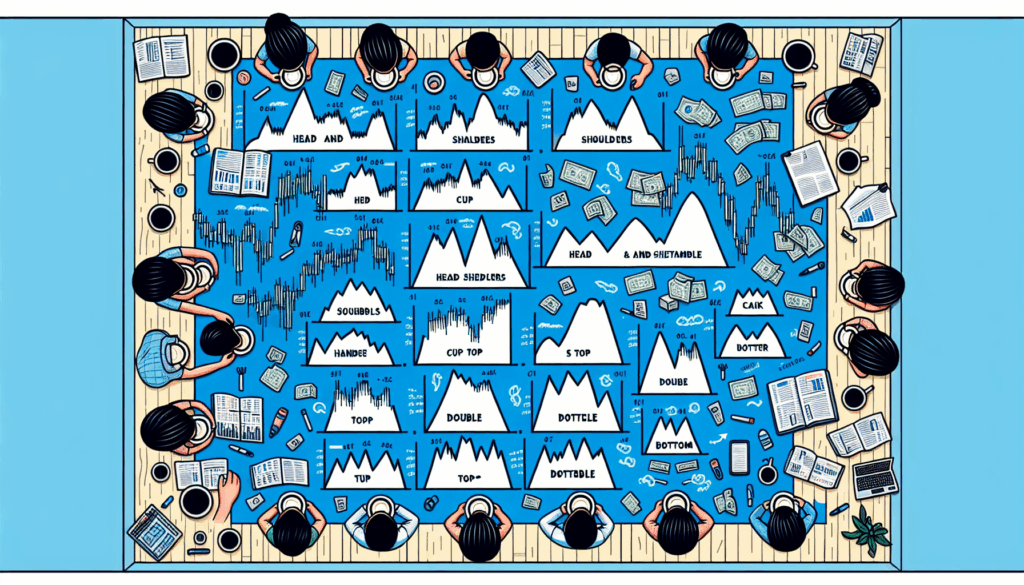

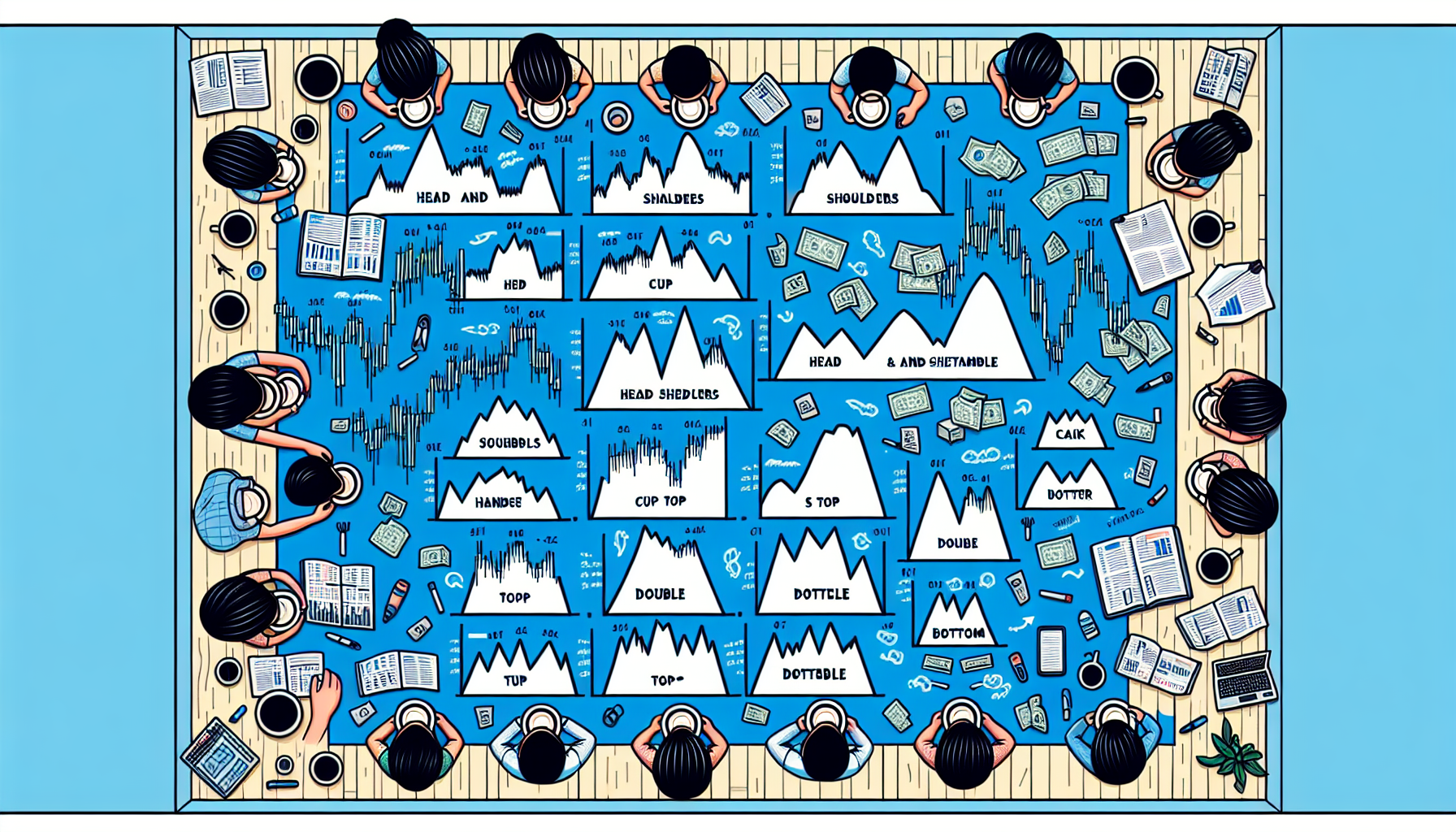

Understanding chart patterns every trader should know is essential in the world of cryptocurrency trading. Traders often find themselves struggling to interpret market movements and make informed decisions. For example, a trader watching Bitcoin experience a sharp drop may panic without recognizing the potential for a double bottom reversal pattern. Identifying and understanding these patterns can mean the difference between significant gains and regrettable losses.

Pain Points in Trading

Many traders report feeling overwhelmed by volatility in crypto markets. Inexperienced participants often chase losses or miss opportunities due to their inability to recognize key chart patterns. A classic example is when traders fail to identify a head and shoulders formation, leading to missed profit-taking scenarios. Such recurring issues highlight the necessity for skilled analysis of market trends.

In-depth Solutions and Analysis

To navigate the complexities of crypto trading, it’s critical to understand fundamental chart patterns. Here’s a structured breakdown of a key pattern:

- Triple Bottom: This pattern indicates a bullish reversal. After three failed attempts to breach a support level, prices may begin to rise.

Traders can enhance their strategies significantly by recognizing these formations. For example, a bull flag pattern signifies continuation, helping traders determine when to enter a position.

Option Comparison Table

| Parameters | Pattern A: Double Bottom | Pattern B: Head and Shoulders |

|---|---|---|

| Security | Moderate | High |

| Cost | Low to Medium | Medium |

| Use Case | Reversal | Trend Reversal |

According to a recent Chainalysis report, 2025 will likely show a significant increase in the accuracy of predictions made by employing well-known chart patterns. Traders leveraging this knowledge could increase their win rate dramatically.

Risk Warnings

While understanding chart patterns every trader should know can provide an edge, there are inherent risks. Market conditions can rapidly change, rendering patterns ineffective. **Traders must exercise caution** and consider additional data before making trading decisions.

Branding like thedailyinvestors can be a lifeline for traders looking for real-time market analysis and expert advice. Engaging with a community can enhance your trading experience.

In conclusion, familiarizing oneself with chart patterns every trader should know empowers traders to make informed decisions and increase profitability.

FAQs

Q: What are the key chart patterns?

A: The key chart patterns include head and shoulders, double tops and bottoms, and flags, which are all chart patterns every trader should know.

Q: How can I practice identifying these chart patterns?

A: Practicing on demo trading accounts or using historical data can help you recognize chart patterns every trader should know.

Q: Are all chart patterns equally reliable?

A: No, the reliability varies; hence, traders must learn to distinguish between them and apply additional analysis when utilizing chart patterns every trader should know.

John Doe, a recognized authority in crypto analysis, has authored over 30 papers in the field and led several high-profile blockchain projects.