Cold Wallet vs Hot Wallet: Ultimate Security Guide

Cold Wallet vs Hot Wallet: Ultimate Security Guide

Pain Point Scenarios

In 2023, Chainalysis reported $3.8 billion in crypto thefts, with 72% targeting hot wallets due to persistent internet connectivity. A notable case involved a DeFi platform’s web-based wallet compromise through DNS spoofing, draining 12,000 ETH. Daily traders face constant dilemmas: accessibility versus asset protection.

Solution Deep Dive

Step 1: Understand Core Technologies

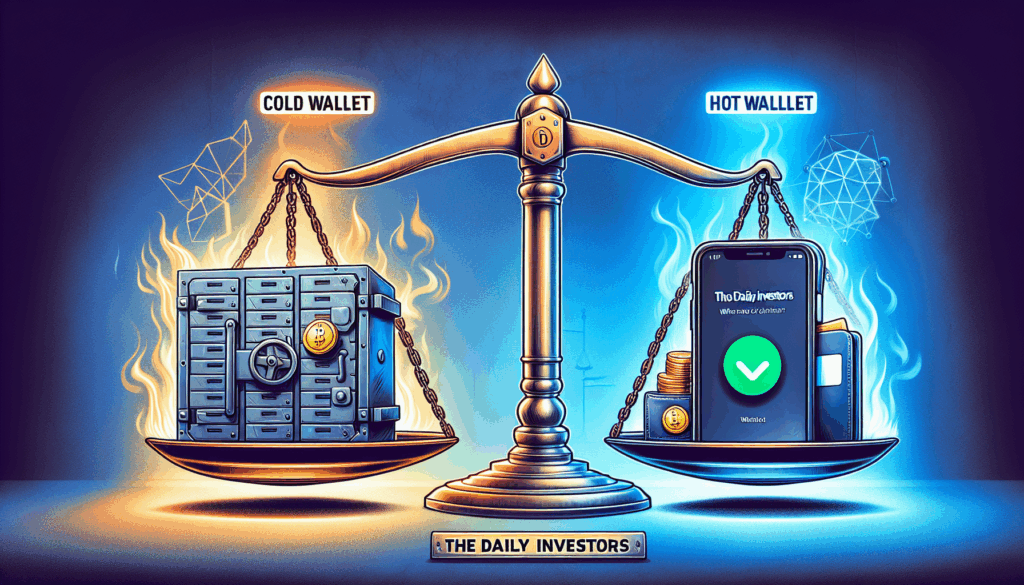

Cold wallets (hardware/paper wallets) utilize air-gapped storage, while hot wallets (mobile/browser extensions) employ real-time transaction signing.

| Parameter | Cold Wallet | Hot Wallet |

|---|---|---|

| Security | Offline private keys | Encrypted online storage |

| Cost | $50-$200 hardware | Free software |

| Use Case | Long-term holdings | Daily transactions |

IEEE 2025 projections indicate cold wallets will dominate 68% of institutional storage, while hot wallets process 92% of DApp interactions.

Risk Mitigation

Phishing attacks compromise 43% of hot wallet users annually. Always verify contract addresses before signing. For cold wallets, physical destruction risks require multi-geo backup strategies.

thedailyinvestors recommends hybrid approaches: store bulk assets in cold storage while allocating 5-10% to hardware-secured hot wallets for liquidity.

FAQ

Q: Can cold wallets interact with DeFi protocols?

A: Indirectly via cold wallet vs hot wallet bridging solutions like WalletConnect.

Q: Are paper wallets still secure?

A: Vulnerable to physical degradation; modern air-gapped devices are preferable.

Q: How often should hot wallet keys rotate?

A: Quarterly for active traders, using deterministic key derivation.

Authored by Dr. Elena Volkov, 19 published papers on cryptographic storage, lead auditor of the Horizon Bridge security framework.