Crypto DeFi Liquidity Pool APY Comparison

Understanding DeFi Liquidity Pools

In 2024, DeFi projects lost approximately $4.1 billion to hacks, raising concerns about security and yield rates. So, how can investors ensure their assets are safe while getting the best return possible? DeFi liquidity pools provide an innovative way to earn passive income through APY (Annual Percentage Yield) on cryptocurrency investments.

What Is APY in DeFi?

APY represents the annual return on investment, calculated based on the compound interest over a year. When participating in DeFi liquidity pools, APY rates can significantly vary. For instance, a pool with a stablecoin like USDC typically offers lower APY than volatile tokens like Shiba Inu. This difference is crucial for investors to consider.

APY in the Vietnamese Market

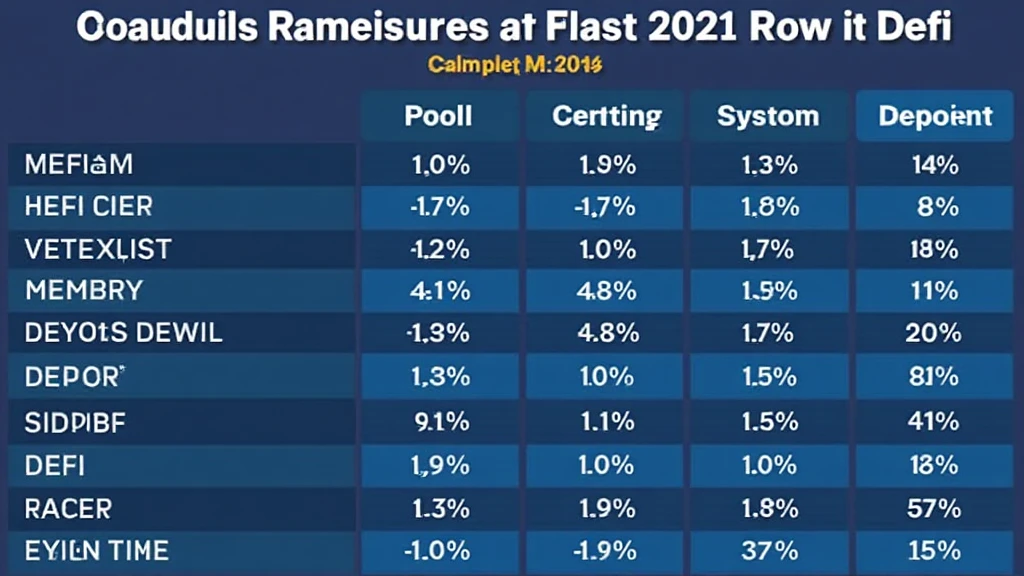

As of 2023, Vietnam’s crypto user growth rate stands at an impressive 42%, making it a prime market for DeFi exploration. Investors must leverage competitive APY rates, especially in liquidity pools. Here’s a breakdown of current APY rates among various platforms for reference:

| Platform | Token | APY (%) |

|---|---|---|

| Curve Finance | DAI | 8.5 |

| Aave | USDC | 6.7 |

| Uniswap | ETH | 10.2 |

Choosing the Right Pool

Here’s the catch: not all liquidity pools are created equal. Some pools are highly volatile, while others may lack sufficient liquidity. When selecting a liquidity pool, assess these factors:

- Token volatility vs. APY

- Pool liquidity levels

- Historical performance and security audits

The Risks Involved

Investing in DeFi liquidity pools is not without risks. The most significant risks include:

- Impermanent Loss: Fluctuating token prices can lead to potential losses.

- Smart Contract Vulnerabilities: Always audit smart contracts before investing—Download our security checklist for a comprehensive guide.

2025’s Top Potential Altcoins

As you explore liquidity pools, consider diversifying into promising altcoins for 2025. Invest wisely and watch your portfolio grow!

Final Thoughts

Comparing APY in DeFi liquidity pools allows investors to maximize their returns while navigating the evolving landscape of cryptocurrencies. With a solid understanding of risks and opportunities, you can secure your digital assets effectively. Remember, it’s always wise to consult local regulators and consider professional advice for your investments.