Understanding Crypto Exchange Deposit Limits: Key Factors and Trends

Understanding Crypto Exchange Deposit Limits: Key Factors and Trends

According to Chainalysis 2025 data, a staggering 73% of cryptocurrency exchanges impose various deposit limits, impacting traders significantly. These limits can often dictate how much you can invest at any given time and influence trading strategies. In this article, we delve into the nuances of crypto exchange deposit limits, addressing common concerns and trends that might affect your trading activities.

1. What Are Deposit Limits in Crypto Exchanges?

To put it simply, deposit limits are like the maximum amount of cash you can put into a vending machine. Just as a machine might only accept a certain number of bills, crypto exchanges set limits on how much cryptocurrency users can deposit within a specific timeframe. These limits can vary widely from one exchange to another and can depend on several factors such as your account verification level or the exchange’s policies.

2. Why Do Exchanges Impose Deposit Limits?

Exchanges implement deposit limits primarily for security and regulatory compliance reasons. Imagine if a supermarket only lets a customer purchase a limited amount of certain products to prevent stockpiling; exchanges do this to manage risk and prevent fraudulent activities. Additionally, these limits help exchanges comply with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, ensuring they operate within legal frameworks.

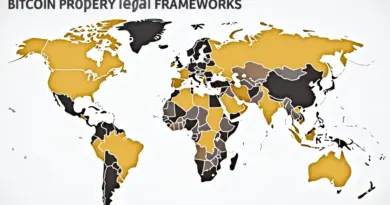

3. How Do Deposit Limits Vary by Region?

Just like how different countries have varying rules for driving, cryptocurrency deposit limits can differ globally. For instance, a user in Singapore might face different regulations compared to someone trading in Dubai, where specific cryptocurrency tax guidelines might apply. It’s crucial for traders to understand their local regulations and how they might influence the deposit limits they encounter on various exchanges.

4. Impact of Deposit Limits on Trading Strategies

When it comes to trading strategies, deposit limits can play a significant role. Similar to how you must consider your budget when planning a road trip, traders must factor in these limits when deciding how much to invest. If your chosen exchange has a low deposit limit, it might restrict your ability to make larger trades or capitalize on market opportunities quickly. Hence, understanding these limits can help traders select the right exchanges that align with their investment goals.

In summary, knowing the ins and outs of crypto exchange deposit limits can provide traders with a strategic advantage. Whether you’re navigating the regulations in Singapore or understanding the implications of limits on your trading strategies, staying informed is crucial.

For those looking to dive deeper into crypto trading, download our comprehensive toolkit today!