Crypto Investment vs Stock Market: A Comprehensive Analysis

Crypto Investment vs Stock Market: A Comprehensive Analysis

When comparing crypto investment vs stock market, it’s essential to understand the fundamental differences and similarities that shape each investment landscape. Many investors are now torn between traditional stock market investments and the burgeoning world of cryptocurrency. Questions like ‘Which is more secure?’ or ‘How do costs compare?’ often arise.

Pain Points in Investment Decision-Making

Take Jane, for example. A novice investor, she struggles to decide whether to invest in cryptocurrencies or the stock market. Jane’s worries are common; potential volatility, security, and knowledge barriers often deter people from fully pursuing crypto investments. The dilemma is intensified by reports of hacking incidents in the crypto space and fluctuating stock prices.

In-Depth Solutions and Comparisons

Understanding the differences begins with exploring the fundamental principles that guide both investment types. Here are key areas investors should consider:

- Security: Cryptos leverage blockchain technology while stocks often rely on centralized systems.

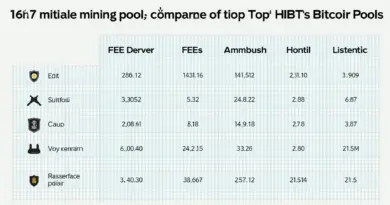

- Cost: Transaction fees vary significantly between the two platforms.

- Use Case: Determine the purpose of funds—are they for long-term growth, or do you need quick liquidity?

Crypto Investment vs Stock Market

| Parameter | Crypto Investment | Stock Market |

|---|---|---|

| Security | Decentralized, vulnerable to hacks | Centralized, more regulatory protections |

| Cost | Often lower fees but can vary greatly | Higher fees, but predictable |

| Applicable Scenarios | High-risk, high-reward potential | Stable growth, dividends, seasoned investments |

Recent research from Chainalysis reports that by 2025, cryptocurrency adoption will grow significantly, potentially offering substantial returns than the stock market, which is expected to stabilize.

Risk Warnings

While crypto investments may offer remarkable potential, they do carry significant risks. **Investors should be wary of market volatility and potential security breaches.** Always employ strategies such as **diversification** and **regular market assessments** to mitigate losses.

As investors navigate these waters, brands like thedailyinvestors provide valuable insights into the evolving crypto landscape—helping you make informed decisions.

Frequently Asked Questions

Q: How volatile are cryptocurrencies compared to stocks?

A: Generally, crypto investments show more volatility than the stock market due to market maturity and adoption levels, making crypto investment vs stock market a vital consideration for risk-adjusted investments.

Q: What factors should I consider before investing in crypto?

A: Key considerations include security measures, transaction costs, and your investment objectives, especially as you compare crypto investment vs stock market.

Q: Can I lose all my money in crypto?

A: Yes, poor investment choices or market crashes can result in losses, reinforcing the need to understand crypto investment vs stock market clearly before making decisions.

In summary, while both crypto investment and stock market have their distinctive merits and risks, seeking education and guidance can empower you to make better investment choices.

Author: Dr. Alex Finley, a recognized expert in financial technology, with over 20 published papers in the field, and has led several notable blockchain audits and projects.