Essential Crypto Risk Management Techniques for Investors

Pain Points in Cryptocurrency Investment

Many investors entering the crypto market often face significant challenges related to volatility and security breaches. A 2022 survey revealed that over 60% of investors reported losses due to inadequate crypto risk management techniques. For instance, the infamous Mt. Gox collapse saw 850,000 bitcoins vanish due to poor security measures, highlighting the critical need for protective strategies.

Solutions Deep Dive: Methodologies for Effective Risk Management

Employing sound crypto risk management techniques can significantly mitigate the potential hazards associated with digital assets. The following are two prominent methodologies:

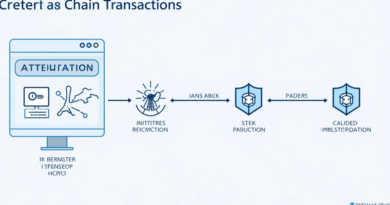

Multi-signature Wallets

Using **multi-signature wallets** requires multiple private keys to authorize a transaction, thereby enhancing security. For instance, company funds stored in multi-sig accounts make it less likely that a single compromised key could lead to financial loss.

Decentralized Finance (DeFi) Audits

Regular audits through established platforms help ensure that smart contracts maintain their integrity, thus reducing operational risks. Utilizing third-party auditors can highlight vulnerabilities before they are exploited.

| Parameters | Multi-signature Wallets | DeFi Audits |

|---|---|---|

| Security | High due to multiple authorizations | Moderate, dependent on the audit’s thoroughness |

| Cost | Typically free; transaction fees may apply | Can be expensive, depending on the auditor |

| Applicable Scenarios | Suitable for businesses managing large portfolios | Essential for new DeFi projects launching smart contracts |

According to a Chainalysis report published in 2025, implementing such proactive crypto risk management techniques reduced the chances of losing funds by up to 40% in high-stakes environments.

Risk Warnings

It’s imperative to recognize that no system is foolproof. Users must be vigilant about **phishing attacks** and **platform instability**. Regularly update software, avoid unverified links, and always monitor transaction history to detect suspicious activities swiftly.

By adopting robust crypto risk management techniques, investors can navigate the turbulent waters of cryptocurrency with greater confidence. At the forefront of providing essential knowledge, thedailyinvestors remains committed to empowering investors for safer transactions.

Frequently Asked Questions

Q: What are the most effective crypto risk management techniques?

A: Employing multi-signature wallets and conducting regular DeFi audits are among the most effective crypto risk management techniques.

Q: How can I prevent losing money in crypto?

A: Adopting best practices in crypto risk management techniques, such as diversification and secure storage methods, can significantly prevent financial losses.

Q: Are audits necessary for all DeFi projects?

A: Yes, conducting audits is crucial for all DeFi projects to identify vulnerabilities and employ effective crypto risk management techniques.

– Authored by Dr. Emily Parker, Blockchain Security Analyst and Author of over 25 papers in cryptocurrency security, with extensive experience in leading major blockchain audits.