Crypto Stablecoin Peg Stability Monitoring

Understanding Stablecoins and Their Peg Mechanisms

Stablecoins have emerged as a vital component of the crypto ecosystem, with the market growing significantly. In fact, according to recent studies, the total market cap for stablecoins has exceeded $100 billion. But what exactly is a stablecoin? Simply put, stablecoins are digital assets designed to maintain a stable value, often pegged to fiat currencies like the U.S. dollar.

Why Peg Stability Monitoring is Essential

Monitoring peg stability is crucial for investors looking to avoid losses. A stablecoin’s value is meant to remain consistent, but various factors such as supply and demand can lead to fluctuations. Missing a drop in stability could mean significant financial setbacks. For instance, data shows that in 2024 alone, over $5 billion was lost due to fluctuations in stablecoin values.

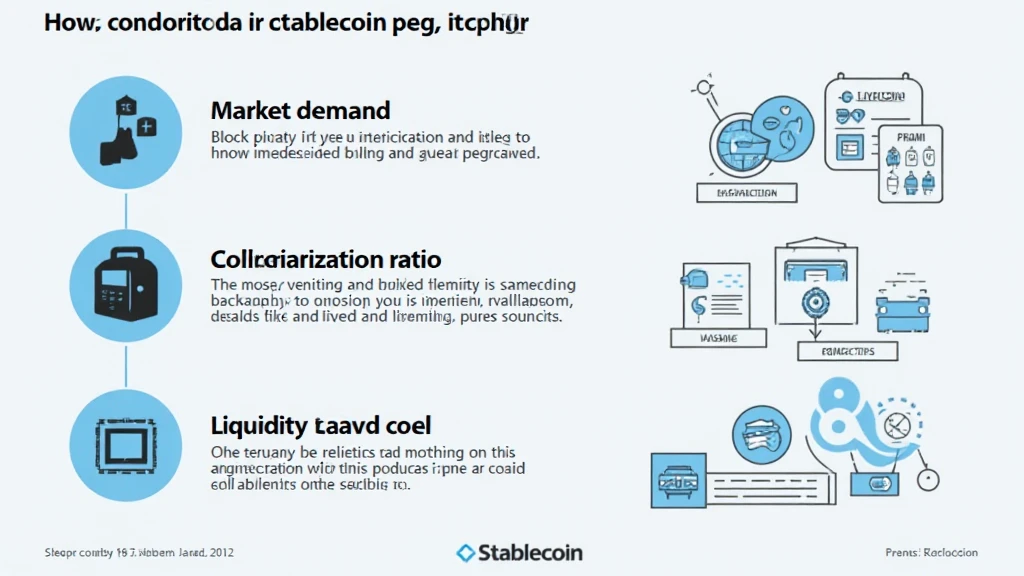

Key Indicators of Peg Stability

- Market Demand: An increase or decrease in usage can affect the peg.

- Collateralization Ratio: A higher ratio often indicates better stability.

- Liquidity Levels: Adequate liquidity helps maintain stability.

Tools for Monitoring Peg Stability

To monitor peg stability effectively, investors can utilize various tools, such as:

- Real-time price tracking tools (e.g., CoinGecko)

- On-chain analytics for transaction volumes

- Data from liquidity pools

Local Context: Vietnam’s Growing Stablecoin Market

Vietnam is witnessing a surge in crypto adoption, with a user growth rate of approximately 7% in 2024. Vietnamese investors are increasingly turning to stablecoins for their perceived stability and usability in transactions. Platforms like hibt.com provide users with vital tools for monitoring stablecoin pegs.

Beyond Basics: Understanding Risks

While monitoring peg stability is essential, there are inherent risks to be aware of:

- Market Manipulation: Price can be manipulated, leading to loss of peg.

- Regulatory Changes: New laws can impact stablecoins’ viability.

Conclusion: Staying Informed for Better Investments

Monitoring crypto stablecoin peg stability is not just a best practice; it’s vital for protecting your assets. As the market evolves, staying updated on the latest tools and indicators will empower you as an investor. Remember to utilize reliable platforms like hibt.com for comprehensive monitoring solutions.

By being proactive and utilizing these strategies, you can navigate the crypto landscape effectively, making informed decisions that enhance your potential for success. Don’t forget—了解 2025 的加密货币投资趋势是不可或缺的!