Understanding Crypto Technical Analysis Basics for 2025 DeFi Trends

Understanding Crypto Technical Analysis Basics for 2025 DeFi Trends

According to Chainalysis data from 2025, a staggering 73% of DeFi projects encounter vulnerabilities that could jeopardize investor security. As the decentralized finance sector matures, understanding crypto technical analysis basics is more crucial than ever for both seasoned investors and newcomers alike.

What is Crypto Technical Analysis?

Think of cryptocurrency technical analysis like the weather forecast for your favorite markets. Just like you check the weather to decide what to wear, you analyze charts and data to predict market movements. It’s all about understanding the patterns in price and volume to help you make informed decisions.

How to Read Charts Effectively?

Reading charts can seem complicated, but it’s much like browsing a menu at your favorite restaurant. Each item tells a story about the market’s past behavior, enabling you to choose your next ‘dish’ wisely. Start with basic indicators like moving averages and trend lines to shape your strategy.

Why is Understanding Market Sentiment Important?

Market sentiment is to crypto trading what customer reviews are to a restaurant. If everyone says a place is great, you’ll likely go there. In crypto, tracking social media and news can help gauge whether investors are feeling bullish or bearish about a coin.

DeFi Regulations and Their Impact on Technical Analysis

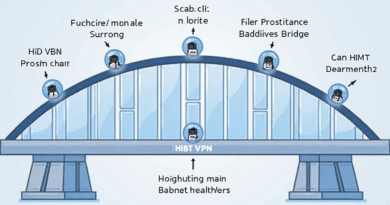

Imagine navigating a new city without a map; it can be daunting! DeFi regulations in regions like Singapore are constantly evolving, just like the streets of a growing city. Understanding these changes is crucial for technical analysis as they directly impact market movements and investor behavior.

To sum up, mastering the crypto technical analysis basics can arm you with the tools needed to navigate the fast-evolving cryptocurrency landscape. Stay informed, adapt your strategies, and don’t miss our free tools to enhance your trading experience!

Check out our comprehensive guide on cross-chain security!

Disclaimer: This article does not constitute investment advice. Please consult your local regulatory authority, such as MAS or SEC, before making any financial decisions. Consider using a Ledger Nano X to significantly reduce the risk of private key exposure.