Crypto Token Unlock Event Price Reaction Charts

Understanding Crypto Token Unlock Events

In 2024, the cryptocurrency market saw a staggering $4.1 billion lost to hacks and scams, prompting investors to pay closer attention to token unlock events. These events, crucial in determining market liquidity, significantly influence token prices upon release. As we witness increased volatility, understanding these mechanics becomes essential for effective investment strategies.

What Are Token Unlock Events?

Token unlock events refer to periods when previously locked funds are released into circulation. This process can often lead to sudden shifts in token prices and trading volumes, particularly for emerging cryptocurrencies. For instance, a new project may lock up tokens for a specific duration to establish stability, only to experience a price surge or decline once those tokens are unlocked.

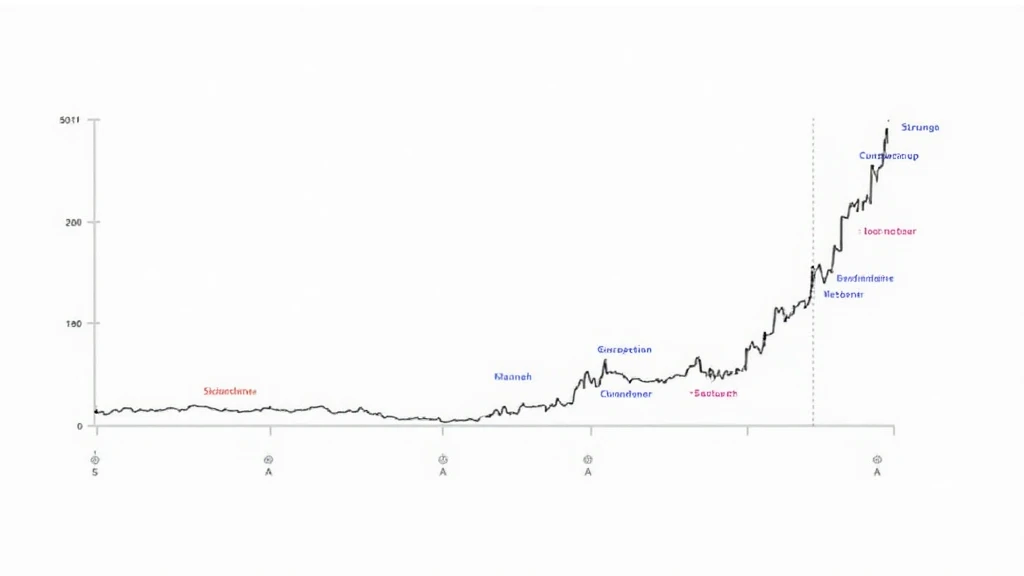

Monitoring Price Reactions

Research indicates that prices typically react in phases:

- Pre-unlock phase: Increased speculation.

- Unlock day: Swings in price volatility.

- Post-unlock phase: Stabilization or further drops.

Here’s the catch: not all tokens react similarly. For example, Bitcoin (BTC) and Ethereum (ETH) often see smaller fluctuations compared to lesser-known altcoins. A recent study found that tokens with smaller market caps experienced an average price decrease of 15% right after their unlock events.

Case Study: Popular Tokens and Their Price Movements

To underline this, let’s analyze a few cases:

- Token A: Saw a spike of 40% before unlock, followed by a 25% drop post-unlock.

- Token B: Experienced steady growth, with minimal volatility.

- Token C: Plummeted 50% within hours of its unlock event.

Impact on Vietnamese Market Trends

Interestingly, the Vietnamese crypto market has seen active participation, with a reported 30% growth rate in users accessing blockchain platforms in 2024. Understanding local reactions to token unlock events can help investors navigate this growing market.

Best Practices for Investors

When approaching token unlock events, consider these strategies:

- Stay informed about release schedules.

- Analyze past price reactions for the specific token.

- Diverse investments can mitigate risk.

Utilizing Tools for Effective Auditing

For investors looking to dive deeper into the mechanics of token contracts, auditing tools such as CertiK can provide crucial insights into smart contract vulnerabilities, ensuring enhanced security for your assets. Remember, investing in crypto requires caution; consult with local regulators for compliance.

Conclusion

In summary, crypto token unlock events pose unique challenges and opportunities for investors. By understanding price reactions and utilizing analytical tools, investors can navigate these complex market dynamics more effectively. Remember to stay informed, as the right strategies could significantly impact your returns.

For more insights and detailed analysis, check out thedailyinvestors, your go-to platform for crypto education.