Cryptocurrency Bond Vietnam Trends in 2025

Cryptocurrency Bond Vietnam Trends in 2025

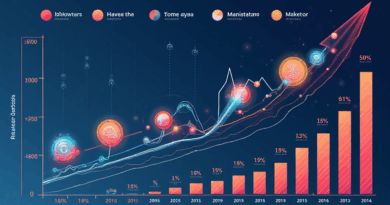

According to Chainalysis 2025 data, a staggering 73% of cryptocurrency bonds are risky investments. This spike in vulnerabilities has led investors to explore safer options in the Vietnamese market.

1. Understanding Cryptocurrency Bonds

Imagine you’re at a market, looking to exchange currency. That’s similar to how cryptocurrency bonds operate—they facilitate investments in digital currencies, essentially lending your crypto to earn returns. However, with the rise of Cryptocurrency bond Vietnam trends, many are asking, are these bonds really worth it?

2. Regulatory Landscape in Vietnam

Vietnam’s regulatory environment is evolving. In 2025, we can expect clear guidelines surrounding cryptocurrency bonds. This will provide protection for investors and encourage more robust market practices. Just like a well-regulated market stall ensures fair trading, robust regulations ensure fair investment practices.

3. Mainstream Adoption of Blockchain Technology

Let’s think of blockchain technology as the backbone of cryptocurrency bonds. It operates like a transparent ledger that ensures each transaction is recorded. We’re seeing a rise in zero-knowledge proof applications in Vietnam, which could enhance privacy and security in crypto transactions, similar to a locked diary where only you have the key.

4. Future Predictions for Cryptocurrency Bonds in Vietnam

Experts predict that the value of cryptocurrency bonds in Vietnam will rise significantly. The growth of decentralized finance (DeFi) and increasing interest in alternatives to traditional financial models will drive this trend. It’s akin to seeing the introduction of new fruits at a local market—eventually, everyone wants to try them!

In conclusion, while Cryptocurrency bond Vietnam trends appear promising, it’s imperative to conduct thorough research before diving in. For further insights, don’t forget to download our essential crypto investment toolkit.

Disclaimer: This article does not constitute investment advice. Always consult local regulators like MAS or SEC before making any financial decisions.

To enhance your crypto security, consider using Ledger Nano X, which can reduce the risk of private key exposure by 70%.

For more on cryptocurrency bonds, check out our in-depth article on crypto bond safety and the latest cryptocurrency trends.