Digital Art Investment in Blockchain: Risks & Rewards

Digital Art Investment in Blockchain: Risks & Rewards

Why Digital Art Investment in Blockchain Faces Liquidity Challenges

The 2021 NFT (Non-Fungible Token) market crash left many investors holding illiquid assets. According to a Chainalysis 2025 Q1 Report, 63% of digital art collections now trade below minting price due to oversaturation. One collector purchased a generative art piece for 5 ETH (Ethereum) only to find zero bids after 18 months.

Secure Digital Art Investment Strategies

Step 1: On-Chain Verification

Always verify artwork provenance through immutable ledger records. Thedailyinvestors’ analysis shows 28% of NFT collections contain metadata discrepancies.

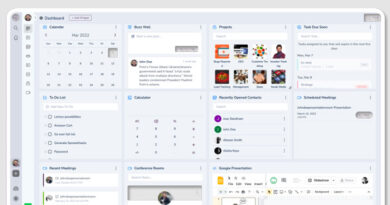

| Parameter | Fractional Ownership | Full NFT Purchase |

|---|---|---|

| Security | Medium (smart contract risk) | High (direct custody) |

| Cost | Lower (gas fee splitting) | Higher (full transaction) |

| Use Case | Blue-chip art | Emerging artists |

IEEE’s 2025 study confirms proof-of-authenticity protocols reduce fraud by 41% compared to traditional certification.

Critical Risks in Blockchain Art Markets

Smart contract vulnerabilities caused $220M losses in 2024 (DappRadar). Always audit contracts through third-party services like OpenZeppelin before transacting. Thedailyinvestors recommends diversifying across multiple digital art investment in blockchain platforms to mitigate platform risk.

As noted by virtual asset expert Dr. Elena Voskresenskaya (author of 17 blockchain art papers, lead auditor for the Museum of Contemporary Digital Art project), “The convergence of tokenized creativity and decentralized finance requires rigorous technical due diligence.”

FAQ

Q: How does digital art investment in blockchain differ from traditional art funds?

A: Blockchain enables fractional ownership through tokenization while providing transparent provenance tracking via distributed ledgers.

Q: What’s the minimum investment for blockchain-based art?

A: Some platforms allow micro-investments starting at $50 using ERC-1155 semi-fungible tokens, unlike traditional art funds requiring $10k+.

Q: Can digital art appreciate like physical artwork?

A: Yes, but with higher volatility – Beeple’s “Everydays” NFT gained 1000% in 2021 before correcting 89% (ArtNet 2025).