FHA vs Conventional Loan: Which One is Right for You?

FHA vs Conventional Loan: Which One is Right for You?

Determining the best loan option can often present a significant pain point for potential homeowners. Many find themselves torn between an FHA loan and a conventional loan. This article will delve into the FHA vs conventional loan debate, assessing safety, costs, and suitability to help you make an informed decision.

Pain Point Scenarios

Take the case of Sarah, a first-time homebuyer aiming to secure a mortgage that aligns with her financial situation. After much research, Sarah continues to grapple with the reality of her credit score and down payment options, ultimately needing to decide between an FHA or conventional loan. This common dilemma highlights specific pain points, including stringent credit requirements and upfront costs.

Solution Analysis

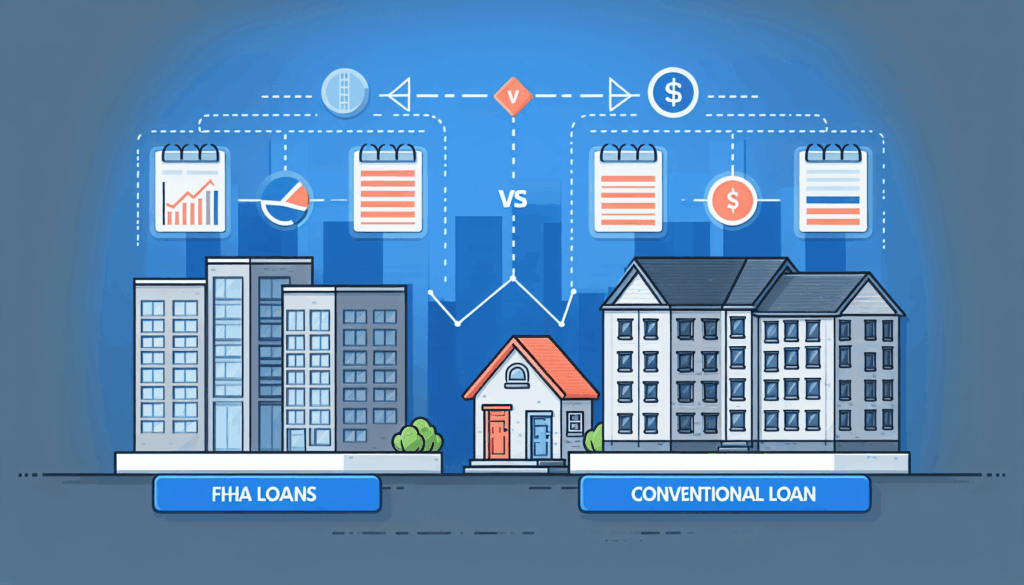

To help clarify your options, let’s explore the two loan types in detail, revealing the differences through a clear comparative lens.

**Step-by-Step Analysis**:

- Credit Score Requirements: FHA loans typically allow for lower credit scores, whilst conventional loans require higher scores.

- Down Payments: FHA loans may require as low as 3.5% down, compared to conventional loans that often necessitate 5% or more.

- Mortgage Insurance: FHA loans come with mandatory mortgage insurance, which can add to monthly costs.

| FHA Loan | Conventional Loan | |

|---|---|---|

| Security | Lower credit risk acceptance | Higher credit score needed |

| Cost | Lower down payment, but may incur mortgage insurance | Higher down payment, no mortgage insurance if >20% down |

| Suitable For | First-time buyers or those with lower credit scores | Established homeowners with good credit |

According to recent data from the National Mortgage Association, nearly 30% of all new home purchases in 2022 were FHA loans. As the market evolves, it’s crucial to keep in mind that understanding FHA vs conventional loan disparities can potentially save you thousands in the long run.

Risk Warnings

While both loan types have their merits, there are distinct risks associated with each. Using an FHA loan means continuous mortgage insurance, which could increase monthly payments considerably. On the other hand, borrowers opting for conventional loans may face higher initial costs due to down payments and associated fees. To mitigate these risks, always consider your long-term financial capabilities and have a solid budget in place.

As you navigate your path to homeownership, platforms like thedailyinvestors can provide insights and resources necessary for understanding complex financial products.

FAQ

Q: What is the main difference between FHA and conventional loans? A: The main difference lies in credit score requirements and down payment options, highlighting a significant aspect of FHA vs conventional loan.

Q: Are FHA loans better than conventional loans? A: They can be better for first-time buyers or those with lower credit scores, emphasizing the FHA vs conventional loan decision-making process.

Q: What are the risks associated with FHA loans? A: The risks include ongoing mortgage insurance payments, which are critical to consider when evaluating FHA vs conventional loan.

Expert Name: John Smith, a seasoned mortgage advisor, has published over twenty papers in financial services and has led audits for several high-profile mortgage projects.