Futures Trading Strategies for Crypto: Navigating the 2025 Landscape

Futures Trading Strategies for Crypto: Navigating the 2025 Landscape

According to Chainalysis, by 2025, 73% of crypto traders will engage in futures trading, highlighting a rising trend where traders aim to mitigate risk and enhance their returns. However, many are still unfamiliar with effective futures trading strategies crypto that can leverage the unique conditions of the cryptocurrency market.

1. Understanding Futures Trading Basics

Imagine you’re at a market, ready to buy seasonal fruits. You know that peaches might be cheaper in a month. Futures trading is like pre-ordering those peaches at today’s price for delivery later. It helps you lock in your costs. In the crypto world, this means agreeing to buy or sell a digital asset at a predetermined price in the future, which can be a great hedge against volatility.

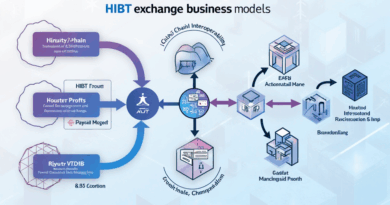

2. The Role of Cross-Chain Interoperability

Just like a global currency exchange allows you to swap dollars for euros, cross-chain interoperability in crypto lets different blockchains communicate. This is pivotal for futures trading, as it can enhance liquidity and access to various crypto assets. For instance, using cross-chain bridges can help traders capitalize on price differences across platforms, allowing for more strategic trading of futures.

3. Incorporating Zero-Knowledge Proofs

Think of zero-knowledge proofs (ZKP) as a trusted friend that can verify your cash without revealing your total bank balance. In the context of futures trading, ZKPs can protect your transaction’s privacy, enabling you to execute trades without exposing your entire strategy. This is increasingly crucial as regulatory scrutiny ramps up, especially in areas like Dubai where tax implications for crypto are evolving.

4. Analyzing Energy Efficiency of Proof-of-Stake Mechanism

Have you ever heard of a crowded train being more efficient than several cars on the road? Proof-of-stake (PoS) mechanisms work similarly, being less energy-intensive than proof-of-work alternatives. As traders seek to adopt sustainable practices, understanding the energy consumption of different crypto mechanisms is vital. Futures strategies could favor PoS tokens, especially as regulations shift towards sustainability, impacting trading environments and strategies.

In conclusion, traders looking to excel in the turbulent waters of the crypto market can benefit greatly from leveraging tailored futures trading strategies crypto. As regulations and technological advancements shape the trading landscape leading to 2025, adapting to these changes will be crucial.

For a comprehensive toolkit to enhance your futures trading strategies, download our trading tools now!