2025 Cross-Chain Bridge Security Audit Guidelines

2025 Cross-Chain Bridge Security Audit Guidelines

According to Chainalysis data from 2025, a staggering 73% of cross-chain bridges contain vulnerabilities that can severely jeopardize user assets. In today’s expanding DeFi landscape, addressing these vulnerabilities is paramount, particularly with innovations like Graph protocol indexing paving the way for more secure cross-chain operations.

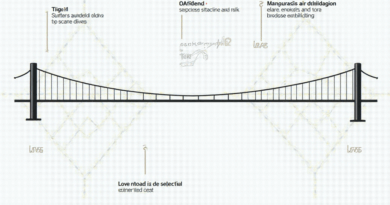

Understanding Cross-Chain Bridges

Think of cross-chain bridges like currency exchange kiosks at your local airport. If you’ve ever traveled internationally, you might have noticed how these kiosks facilitate the conversion of one currency into another, allowing you to spend money seamlessly in different countries. Similarly, cross-chain bridges enable users to transfer assets across different blockchain networks, enhancing interoperability. With Graph protocol indexing, these bridges can become more efficient and secure.

Common Vulnerabilities Found in Cross-Chain Protocols

Many cryptocurrency users might be unaware that just like bank tellers can sometimes miscount cash, cross-chain protocols can also miscalculate or fail in transfer functions. Research by CoinGecko in 2025 reveals that issues such as flawed smart contract coding or insufficient testing lead to numerous exploits. Eliminating these vulnerabilities requires rigorous security audits and constant updates to the indexing methods used in these protocols.

Zero-Knowledge Proofs: Enhancing Security

You might have heard of zero-knowledge proofs, a cryptographic method that can be likened to a magician performing a trick where they prove they’ve pulled a rabbit from a hat without revealing how they did it. In the world of blockchain, this means verifying transactions without revealing the data itself, thus enhancing user privacy and security. By implementing zero-knowledge proofs in indexing, platforms utilizing Graph protocol can significantly reduce attack surfaces.

Future Trends in DeFi Regulatory Frameworks

An emerging trend in the DeFi space is the introduction of regulatory frameworks, especially for regions like Singapore. By 2025, we can expect stricter compliance requirements to combat fraud and protect investors. The goal is to create a safer ecosystem for users while allowing innovation to flourish. This regulatory oversight will necessitate more robust security audits on cross-chain bridges to ensure they meet compliance standards.

In conclusion, understanding the importance of Graph protocol indexing is crucial for improving security in the DeFi space. As vulnerabilities continue to plague cross-chain bridges, it’s clear that continued innovation and regulatory oversight will be essential to safeguarding user assets.

For those looking to deepen their understanding, we invite you to view our cross-chain security white paper to learn more about the evolving landscape of blockchain interoperability.

Disclaimer: This article does not constitute investment advice. Always consult local regulatory bodies (such as MAS, SEC) before making financial decisions. To reduce risks, we recommend using tools like Ledger Nano X to cut down the risk of private key leakage by 70%.