2025 Bitcoin AML Policies: Navigating Compliance Challenges

2025 Bitcoin AML Policies: Navigating Compliance Challenges

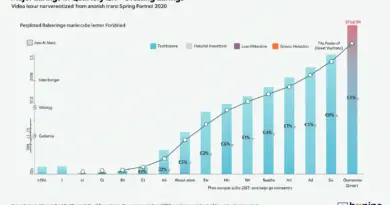

According to data from Chainalysis 2025, a staggering 73% of cross-chain bridges exhibit significant vulnerabilities, raising pressing questions around compliance and security in the crypto space. One critical aspect that traders and investors need to be aware of is the evolving environment of HIBT Bitcoin AML policies.

Understanding HIBT Bitcoin AML Policies: What You Need to Know

Firstly, let’s simplify what HIBT Bitcoin AML policies are. Think of it like a grocery store that requires customers to show a valid ID before purchasing alcohol. In the same way, HIBT requires crypto transactions to pass through certain compliance checks to combat money laundering.

The Importance of Cross-Chain Interoperability

Imagine trying to exchange dollars for euros at a busy airport. The process can be complex if the various money exchange booths don’t work well together. Similarly, cross-chain interoperability is crucial in crypto to facilitate smooth transactions across different platforms while adhering to AML regulations.

Zero-Knowledge Proofs: The Future of Privacy

If you’ve ever used a self-service checkout, you know you can keep your purchases discreet. Zero-knowledge proofs work in much the same way, enabling transactions to be verified without revealing sensitive information, which could enhance compliance with HIBT Bitcoin AML policies.

2025 Regulatory Trends in Singapore’s Crypto Space

As a hub for financial services, Singapore is tightening DeFi regulations. You might think of it like stricter dining rules at a restaurant; the changes are meant to protect everyone involved. Monitoring and compliant interaction with HIBT Bitcoin AML policies will be essential for participants in 2025.

In conclusion, as the regulatory environment around Bitcoin continues to evolve significantly, understanding and adhering to HIBT Bitcoin AML policies will become vital for maintaining compliance and ensuring transactional safety. For more insights, download our comprehensive toolkit.

View our cross-chain safety white paper and stay informed of the latest regulations!

Disclaimer: This article does not constitute investment advice. Please consult local regulatory bodies such as the MAS or SEC before making any financial decisions.

Risk Mitigation: Consider using Ledger Nano X, which can significantly reduce private key exposure risks by 70%.