A Clear Understanding of HIBT Bitcoin Exchange Fee Breakdown

A Clear Understanding of HIBT Bitcoin Exchange Fee Breakdown

According to Chainalysis 2025 data, a staggering 73% of Bitcoin transactions incur hidden fees that traders are often unaware of. Understanding these fees is crucial to optimizing your trading strategy. In this article, we will provide you with an in-depth breakdown of the HIBT Bitcoin exchange fee structure, ensuring you are better equipped to navigate the complexities of cryptocurrency trading.

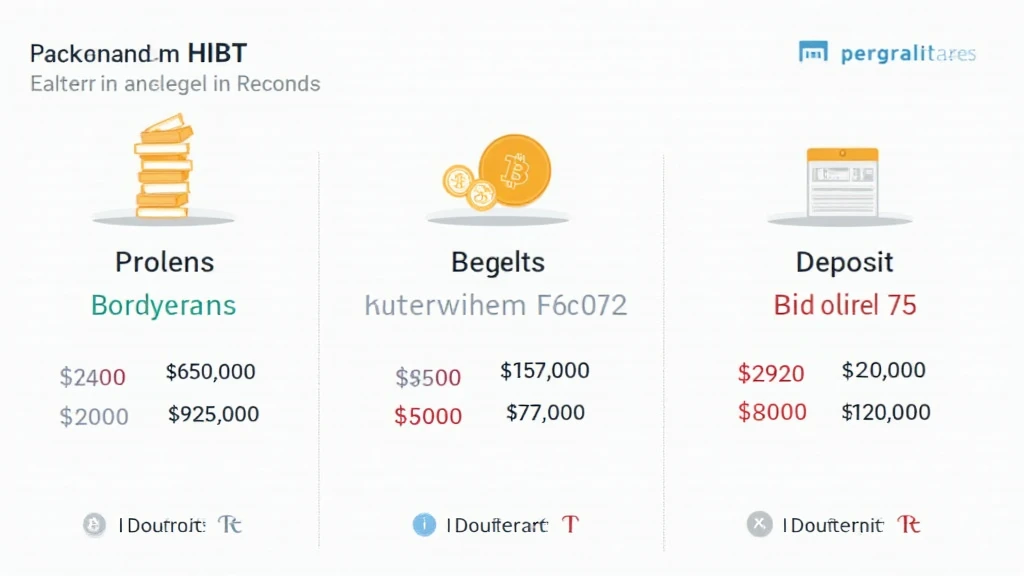

What Fees Should You Expect When Using HIBT?

When you trade Bitcoin on HIBT, much like exchanging currencies at a kiosk, you’ll encounter various fees. These can include trading fees, withdrawal fees, and deposit fees. Think of trading fees like the extra coins you’d pay to the exchanger for their service. For instance, if you wanted to trade $100 worth of Bitcoin, a 0.5% trading fee would mean you lose 50 cents immediately. Understanding these nuances helps you prepare for the actual cost of your transactions.

How Do Withdrawal Fees Impact Your Bottom Line?

Withdrawing funds from HIBT is another critical aspect to consider. Withdrawal fees can be compared to the delivery charges you pay when your favorite dish gets delivered to your home. Depending on how long you intend to store your Bitcoin on the exchange, these fees may affect your overall profitability. Before transferring your Bitcoin to a personal wallet, make sure you know how much you’ll be losing on these fees.

Do HIBT Fees Vary by Region?

Depending on where you’re located—be it Dubai or Singapore—the fees associated with the HIBT Bitcoin exchange can differ. The local regulations and market conditions can significantly impact these fees. For instance, in Dubai, crypto transactions might have different tax implications compared to those in Singapore. It’s essential to check specific regional guidelines to avoid unnecessary costs.

How Can You Minimize HIBT Exchange Fees?

Reducing transaction costs on HIBT is possible, much like how you’d look for discounts while shopping online. Utilize strategies such as trading during off-peak hours when fees might be lower and aggregating your transactions to save on withdrawal costs. Knowing when and how to trade can make a significant difference to your investment returns.

In summary, understanding the HIBT Bitcoin exchange fee breakdown is vital for savvy cryptocurrency traders. By familiarizing yourself with the fees, you can make informed decisions that bolster your trading effectiveness and profitability. For more information on how to effectively navigate the cryptocurrency landscape, download our comprehensive toolkit.

**Disclaimer:** This article does not constitute investment advice. Always consult local regulatory bodies such as MAS or SEC before making financial decisions.

**Tool Recommendation:** Consider using Ledger Nano X to significantly reduce the risk of private key exposure by up to 70%.

For more insights, check out our detailed resources on HIBT.

Visit HIBT for more information on navigating cryptocurrency fees.

Download Our Crypto Toolkit Now!

Equip yourself with essential tools and information for successful trading!