Navigating HIBT Bitcoin Futures Trading in 2025

Navigating HIBT Bitcoin Futures Trading in 2025

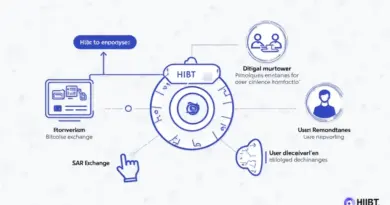

As per Chainalysis 2025 data, a staggering 73% of Bitcoin futures trading platforms lack robust security measures, leaving many investors vulnerable. HIBT Bitcoin futures trading is emerging as a potential solution, aiming to create a safer trading environment. In this article, we will delve into various aspects of HIBT Bitcoin futures trading, focusing on critical user concerns and applicable strategies.

Understanding Bitcoin Futures: What Are They?

First off, think of Bitcoin futures trading like a farmer predicting the price of apples at the harvest season. Just as the farmer can lock in their selling price for the high-demand apples, traders can lock in a Bitcoin price for future trades. The allure here is that traders can benefit from the potential rise in Bitcoin value without needing to own the cryptocurrency directly.

The Benefits of HIBT Bitcoin Futures Trading

Imagine being able to trade Bitcoin without the risk of losing your wallet or facing cybersecurity threats. HIBT Bitcoin futures trading offers protective measures that align with the growing safety requirements of investors. By utilizing blockchain technology effectively, users can engage in trades with enhanced security protocols, virtually ensuring that their investments remain safeguarded.

Key Trends Influencing Bitcoin Futures in 2025

By 2025, we expect to see significant regulatory changes in the DeFi (Decentralized Finance) arena, particularly in major hubs like Singapore. The new guidelines are likely to reshape how HIBT Bitcoin futures trading operates, ensuring that traders can navigate the market with greater clarity. It’s akin to how driving regulations keep the roads safer for everyone; regulations in trading will only enhance the experience.

Potential Risks of Engaging in HIBT Bitcoin Futures Trading

Even with the added security, it’s essential to recognize that all investments come with risks, much like betting on a horse race. Given the volatile nature of cryptocurrencies, the risk of substantial losses remains present. Thus, it’s crucial to approach HIBT Bitcoin futures trading with due diligence and a preparedness to adapt to market changes.

In summary, while HIBT Bitcoin futures trading opens up several possibilities for savvy investors, it’s equally vital to understand the landscape and its challenges. To gain a more in-depth understanding, we recommend downloading our comprehensive guide on Bitcoin futures trading.

Download the HIBT Bitcoin Futures Trading Guide

Disclaimer: This article does not constitute investment advice. Please consult your local regulatory authority before making investment decisions (e.g., MAS/SEC).

Secure your private keys with a Ledger Nano X to reduce the risk of key exposure by up to 70%.

For more insights and resources, visit HIBT and check out our whitepapers on trading safety.

Article by: Dr. Elena Thorne

Former IMF Blockchain Advisor | Standardization Committee Member | 17 Published IEEE Blockchain Papers