2025 Bitcoin Liquidity Mining Strategies Revealed

2025 Bitcoin Liquidity Mining Strategies Revealed

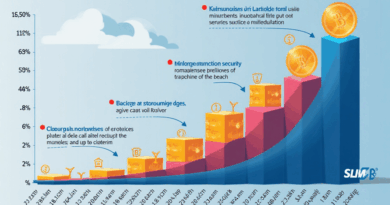

According to Chainalysis 2025 data, a staggering 73% of global liquidity pools exhibit vulnerabilities that could be exploited. With the rise of decentralized finance (DeFi) and Bitcoin liquidity mining, it’s essential to navigate these waters carefully. This report dives into HIBT Bitcoin liquidity mining strategies, covering what you need to know to secure your assets.

Understanding Bitcoin Liquidity Mining: A Market Stall Analogy

You might have encountered a busy market where vendors exchange goods. Imagine liquidity mining as a bustling market stall where traders swap their Bitcoin for other cryptocurrencies. The more liquidity you provide, the more transactions happen, just like a popular stall attracts more customers. However, not every market stall is equally safe—some can be trickier than others.

Future Trends in DeFi Regulation: What’s Coming in 2025?

As countries like Singapore draft new regulations for DeFi, understanding these trends is crucial. In 2025, Singapore’s regulatory landscape is expected to solidify, ensuring that DeFi platforms operate transparently and safely. This is particularly relevant for participants in HIBT Bitcoin liquidity mining who want to stay compliant while maximizing their yields.

Comparing PoS Mechanism Energy Consumption

When discussing Bitcoin and its energy consumption, think of it as comparing different cooking methods. Proof of Stake (PoS) is like using an energy-efficient slow cooker, while Bitcoin mining is akin to blasting an oven at full power. HIBT Bitcoin liquidity mining can provide a greener alternative by leveraging less energy-intensive methods.

Tips for Minimizing Risks in Liquidity Pools

Just like setting up your market stall, several best practices can help minimize risks in liquidity pools. Ensure you analyze the pool’s historical data, check for smart contract audits, and diversify your liquidity investments. Implementing the use of a hardware wallet like Ledger Nano X can reduce the risk of private key exposure by up to 70%—always a good practice in crypto trading.

In conclusion, as we step into 2025, strategies around HIBT Bitcoin liquidity mining will be critical for navigating the risks involved. Be proactive, stay informed, and check out our tools for more insights.

Download our toolkit for advanced strategies here!

Disclaimer: This article is not investment advice. Please consult your local regulatory authority (like MAS/SEC) before making any financial decisions.

For more insights, visit hibt.com and check our comprehensive guides on crypto safety.