2025 HIBT Bitcoin Market Depth Analysis: Understanding Trading Dynamics

2025 HIBT Bitcoin Market Depth Analysis: Understanding Trading Dynamics

According to Chainalysis data from 2025, a staggering 73% of cryptocurrency exchanges exhibit significant vulnerabilities. This alarming statistic underscores the importance of reliable market depth analysis when navigating the volatile waters of Bitcoin trading.

What Is Market Depth and Why Does It Matter?

Market depth refers to the ability of a market to sustain relatively large market orders without impacting the price of the asset significantly. Think of it like a busy farmer’s market – the more stalls with fresh produce available, the easier it is for buyers to find the fruits they want without significantly altering prices. Understanding market depth can help you avoid being on the unfortunate side of a price swing during your Bitcoin trades.

Analyzing Bitcoin Market Depth

One tool to consider while analyzing Bitcoin market depth is to look at depth charts, which display buy and sell orders at various prices. For example, if you see a high concentration of buy orders at a certain price level, it’s like spotting a long line at one vendor versus another. Traders might flock to those price points, resulting in less volatility. This insight can guide your trading strategies effectively.

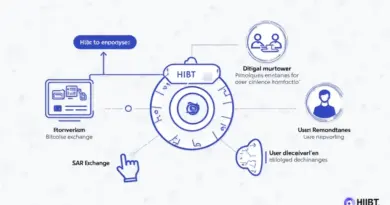

Key Takeaways from HIBT Data

In reviewing HIBT Bitcoin market depth analysis, two critical insights emerge: the volatility of liquidity and the importance of timely data. With 2025 projections indicating continued interest in cryptocurrencies, being aware of liquidity levels helps you make informed trading decisions. Just like in a bustling market, if one stall runs out of stock, it’ll affect the flow at others!

Navigating Market Risks with Confidence

With vital data at your fingertips, leveraging tools like the Ledger Nano X can significantly reduce the risk of private key exposure by up to 70%. Remember, this isn’t just about the Bitcoin market; it’s about securing your investments. Taking proactive steps to mitigate risk matters as much as choosing the right trading strategy.

In conclusion, understanding HIBT Bitcoin market depth analysis is crucial for any trader aiming to succeed in a rapidly evolving landscape. To truly navigate these waters, download our comprehensive toolkit on cryptocurrency trading best practices today!

Check out the full HIBT market analysis for deeper insights. Remember, this article does not constitute investment advice. Always consult with your local regulatory authorities like the MAS or SEC before making investment decisions.

Author:

【Dr. Elena Thorne】

前IMF区块链顾问 | ISO/TC 307标准制定者 | 发表17篇IEEE区块链论文

Stay informed with us at The Daily Investors!