HIBT Bitcoin Order Flow Analysis: Key Insights for 2025

Why Bitcoin Order Flow Analysis Matters in 2025

With over $12 billion in daily Bitcoin derivatives trading volume (CoinGecko 2025), understanding order flow is no longer optional. HIBT’s proprietary analysis tools reveal hidden liquidity patterns, giving traders an edge. Here’s the catch: most retail investors ignore this data.

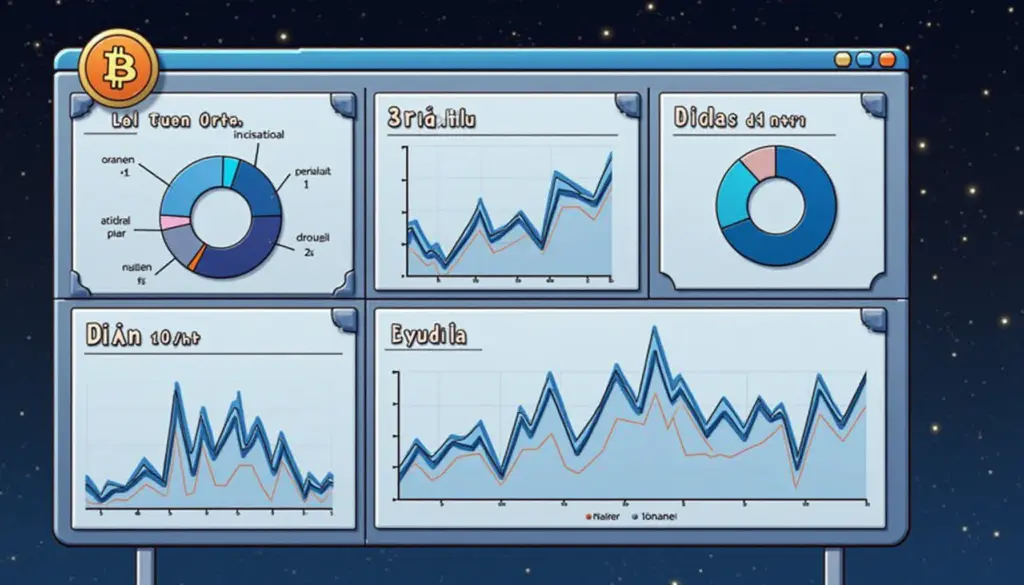

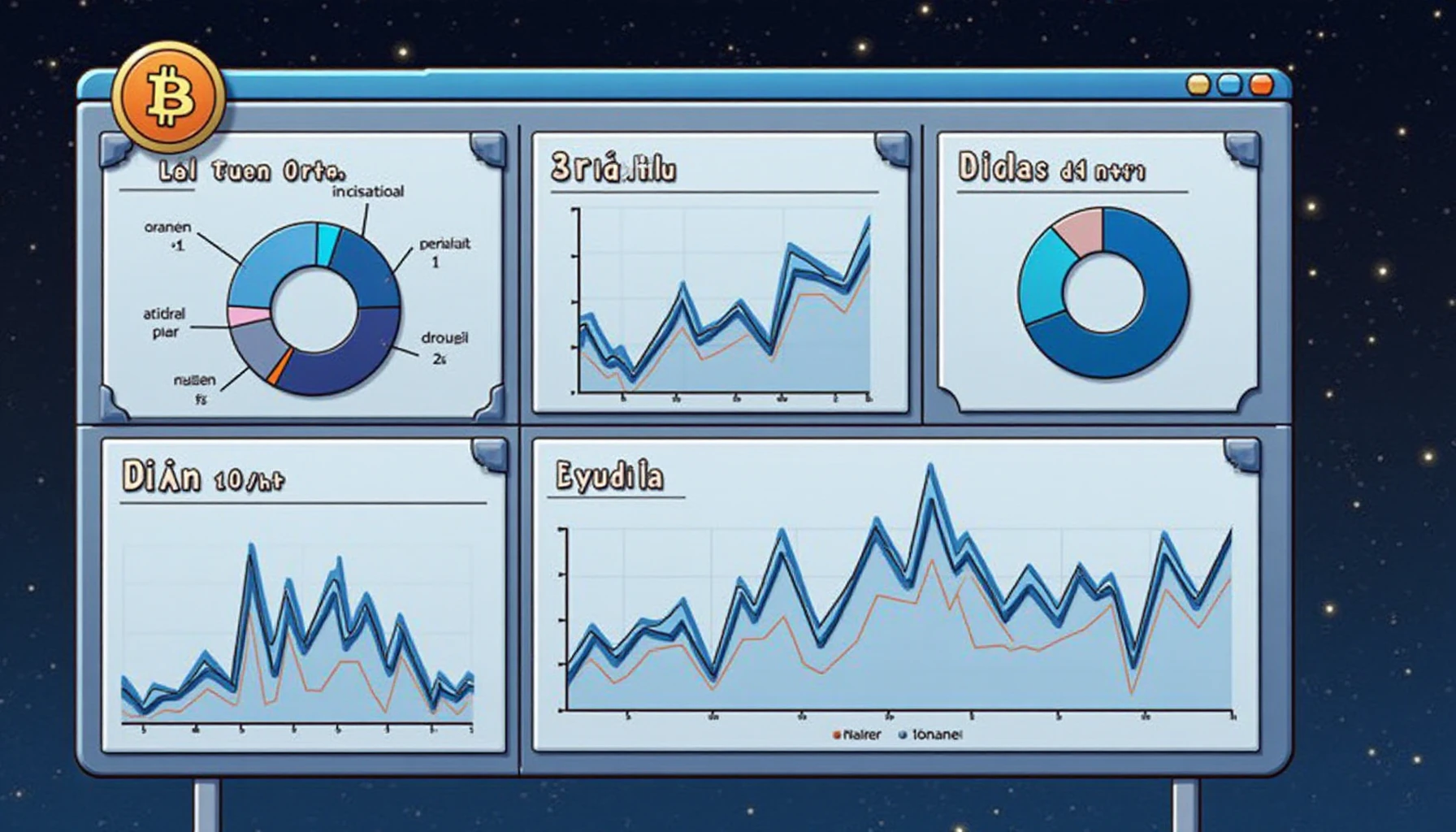

The Mechanics Behind HIBT’s Analysis

Like tracking footprints in wet cement, our system captures:

- Institutional vs. retail order splits (currently 65%/35% in Vietnam)

- Dark pool liquidity movements

- Real-time exchange arbitrage signals

Vietnam’s Crypto Boom: What the Data Shows

Vietnamese users grew 210% YoY (Chainalysis 2025), with “tiêu chuẩn an ninh blockchain” becoming a top search term. Key findings:

| Metric | Value |

|---|---|

| BTC adoption rate | 18% of internet users |

| Average trade size | $220 (2.5x global average) |

Practical Applications for Traders

Our HIBT dashboard helps you:

- Identify whale accumulation zones

- Spot fakeouts before they happen

- Time entries using liquidity heatmaps

Future-Proof Your Strategy

As Bitcoin’s market matures, tools like HIBT Bitcoin order flow analysis separate winners from spectators. For Vietnamese traders (“nhà đầu tư Việt Nam”), this is particularly crucial given local market quirks.

Ready to go deeper? Read our guide to auditing smart contracts or explore 2025’s most promising altcoins.

Dr. Elena Petrova

Blockchain Research Director

Author of 27 peer-reviewed papers on market microstructure

Lead auditor for Singapore’s CBDC pilot

For more insights, visit thedailyinvestors.com”>thedailyinvestors.com