2025 HIBT Bond Liquidity Metrics Overview

2025 HIBT Bond Liquidity Metrics Overview

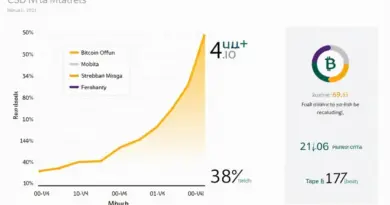

According to Chainalysis 2025 data, a staggering 73% of cross-chain bridges have vulnerabilities. With the rise of decentralized finance, understanding HIBT bond liquidity metrics is crucial for traders and investors alike.

Understanding HIBT Bond Liquidity Metrics

Imagine a farmer needing to exchange apples for oranges at a marketplace. That’s how liquidity works in the bond market. If buyers and sellers can easily transact, prices remain stable. However, when liquidity is low, just like limited fruits at a market, prices can swing wildly. HIBT bond liquidity metrics help investors gauge how easy it is to buy or sell bonds.

The Importance of Cross-Chain Interoperability

Cross-chain interoperability is akin to a bridge allowing pedestrians to walk from one side of a river to another. For bonds, it means that investors can operate across different blockchain networks seamlessly. The more robust the interoperability, the higher the HIBT liquidity metrics, leading to better trading environments.

Exploring zk Proof Applications

Zero-Knowledge (zk) proofs are like a secret handshake between two friends that confirm they know each other without giving away personal details. Similarly, zk proofs allow transactions to be validated without revealing all information on the blockchain. This increases user privacy and can enhance liquidity in HIBT bonds by making investors feel more secure in their transactions.

Upcoming Trends in Bond Markets: Local Insights

Looking ahead, the 2025 trends in Singapore’s DeFi regulations are likely to shape HIBT bond markets significantly. Regulatory clarity can mean safer trading environments, leading to improved bond liquidity metrics. As regulations evolve, local investors can expect a more transparent and trustworthy market.

In summary, understanding HIBT bond liquidity metrics is essential for navigating the ever-changing landscape of bond trading, especially as we look towards the increased adoption of cross-chain technologies and privacy-focused zk proofs. For more insights and tools that can help optimize your trading strategies, download our comprehensive toolkit.

Disclaimer: This article does not constitute investment advice. Always consult with local regulatory bodies such as MAS or SEC before making trading decisions.

Dr. Elena Thorne

Former IMF Blockchain Consultant | ISO/TC 307 Standards Developer | Author of 17 IEEE Blockchain Papers