Understanding HIBT Bond Market Dynamics in 2025

Understanding HIBT Bond Market Dynamics in 2025

According to Chainalysis 2025 data, a staggering 73% of financial markets are exposed to vulnerabilities that could threaten stability, making the research into HIBT bond market dynamics crucial for investors and regulators alike. With the shifting trends in decentralized finance (DeFi) and the growing scrutiny on crypto regulations, understanding these dynamics can provide a clearer roadmap for the future.

What are HIBT Bond Market Dynamics?

You might be wondering what exactly HIBT bond market dynamics refer to. Essentially, think of it as the behavior of bond prices and yields in a highly interconnected financial ecosystem. Just like a market vendor adjusting prices based on supply and demand, the bond market reacts to various economic indicators, inflation rates, and foreign interest. This is especially important in regions like Dubai’s cryptocurrency tax regulations, which can significantly impact market behavior.

How Do Cross-Chain Interoperability and Zero-Knowledge Proof Applications Fit In?

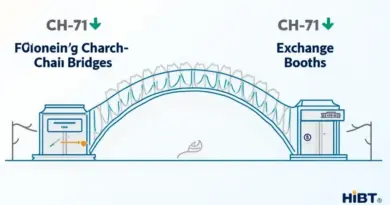

Imagine cross-chain interoperability as a currency exchange booth at a busy marketplace. It allows different cryptocurrencies to interact seamlessly, making trading smoother. In the same way, zero-knowledge proof technology ensures privacy while confirming transactions without revealing sensitive data. Together, they enhance the HIBT bond market dynamics by promoting trust and efficiency.

What is the Impact of Regulatory Trends on HIBT Bonds?

With Singapore’s 2025 DeFi regulatory trends around the corner, many investors are questioning how these laws will affect their bond investments. Regulations can both stabilize and complicate the market, similar to how traffic lights control the flow of vehicles. Proper guidelines can lead to safer investments, while ambiguity can create chaos, making it critical for investors to stay informed.

What Are the Risks and Precautions in the Current Bond Market?

Risk management in the bond market is essential. Just as you wouldn’t store all your money in one basket, diversifying your investments is critical. Using tools like the Ledger Nano X can lower the risk of private key exposure by up to 70%, providing an additional layer of security for your digital assets.

In conclusion, navigating the HIBT bond market dynamics requires a keen understanding of various influencing factors such as regulatory trends, technological advancements, and risk management strategies. For your financial toolkit, consider downloading our comprehensive guide on bond market trends. Download Now

Article by Dr. Elena Thorne | Former IMF Blockchain Consultant | ISO/TC 307 Standards Author | Published 17 IEEE Blockchain Papers

Please note: This article does not constitute investment advice. Always consult your local regulatory authority before making investment decisions.

For further information, view our whitepapers on cross-chain security and explore more insights at hibt.com.