2025 HIBT Bond Market Forecasts: An Insight into Securities

Introduction

According to Chainalysis data from 2025, a staggering 73% of bond securities transactions are at risk due to inefficiencies in today’s bond market. This begs the question: what lies ahead in the HIBT bond market forecasts?

Understanding Bond Market Dynamics

Think of the bond market like a bustling farmers’ market. Individual vendors (issuers) offer their goods (bonds) to buyers, ensuring a variety of choices. Just as a savvy shopper is aware of price trends and product freshness, investors must navigate fluctuating interest rates and economic indicators affecting bond valuations.

The Impact of Regulatory Changes

Just as you might encounter new health guidelines at a local market, upcoming regulations could reshape the bond landscape in significant ways. For instance, Singapore’s regulatory stance on DeFi platforms could potentially usher in a new era for bond trading by increasing transparency and trust. The 2025 DeFi regulatory framework could determine whether bond markets become more robust.

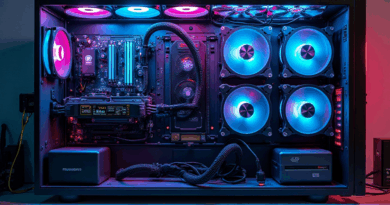

Technological Innovations in the Bond Market

Innovation is the lifeblood of the bond market. Consider blockchain technology; it acts like a digital ledger that records every transaction, offering security and visibility like never before. In 2025, the implementation of zero-knowledge proofs could further enhance security, ensuring that sensitive transaction details remain confidential while still validating transactions.

Environmental Considerations of Bond Investments

The ongoing discourse around sustainability mirrors the awareness of eco-friendly buying in our daily lives. When comparing the PoS mechanism energy consumption with traditional systems, yields might soon start reflecting the green credentials of assets, pushing investors to consider the environmental impacts of their choices seriously.

Conclusion

In conclusion, the landscape of the HIBT bond market in 2025 is redefining itself through technology and regulation. As you explore these opportunities, consider tools like the Ledger Nano X, which reportedly lowers the risk of private key exposure by 70%. For a deeper understanding, download our toolkit.

Disclaimer

This article is for informational purposes only and does not constitute investment advice. Always consult with your local regulatory bodies such as MAS or SEC before making investment decisions.