2025 HIBT Bond Market Predictions: What to Expect

2025 HIBT Bond Market Predictions: What to Expect

As per Chainalysis 2025 data, a staggering 73% of the global bond market may face volatility due to impending regulatory shifts. Investors are eager to understand how these changes might impact their portfolios, especially in a world that’s increasingly leaning towards technology integration.

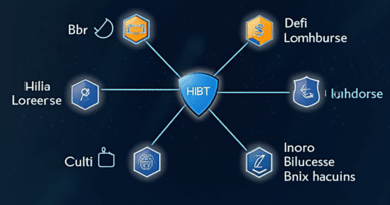

Understanding HIBT Bonds: A Primer

Imagine walking into a marketplace filled with various stalls, each representing different types of investments. In this scenario, HIBT bonds act as a reliable vendor that offers stable returns despite the noisy environment. Just like how you’d assess quality before making a purchase, discerning investors are looking closely at the stability of these bonds as opposed to the more volatile assets in the crypto space.

Impact of New Regulations on HIBT Bonds

Similar to adjusting your strategy in a cooking competition based on the ingredients at hand, bond investors must adapt to new regulations emerging in 2025. For instance, the anticipated regulations surrounding DeFi in places like Dubai can reshape the landscape of HIBT investments significantly, where safety and compliance take precedence over speculative gains.

Comparative Analysis: PoS Mechanism’s Energy Consumption

Think of the energy consumption of various investment strategies as the fuel efficiency of vehicles. Bonds are like electric cars – efficient and low on emissions, offering predictable performance. In this comparison, investors are contemplating whether PoS mechanisms can compare favorably against traditional methods regarding energy consumption and cost-effectiveness while making HIBT bonds more appealing.

Navigating Opportunities in a Tech-Driven Market

In a tech-driven market, opportunities sprout like weeds in a garden. Investors who understand how to leverage technologies like zero-knowledge proofs can ensure their HIBT bonds remain robust against potential fraud or data breaches. Just as a good gardener knows when to prune and nurture plants, savvy investors will utilize technology wisely to maximize their returns.

Conclusion: As we look ahead at the HIBT bond market predictions, understanding the evolving trends is essential for navigating investments effectively. Interested in diving deeper? Download our comprehensive toolkit that outlines strategic insights and risk management tactics.

Check out our white paper on cross-chain security and learn how these predictions could influence your investment strategy!

Disclaimer: This article does not constitute investment advice. Always consult your local regulatory authorities, such as MAS or SEC, before making investment decisions.

Tools to consider: Using a Ledger Nano X can reduce the risk of private key compromises by up to 70%.

Article by: Dr. Elena Thorne

Former IMF Blockchain Advisor | ISO/TC 307 Standard Developer | Published 17 IEEE Blockchain Papers