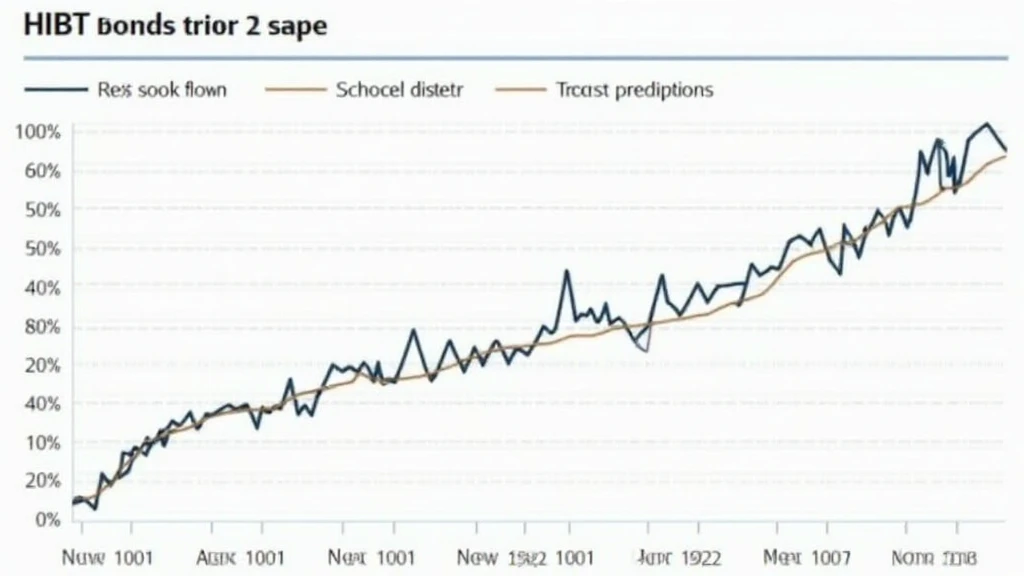

HIBT Bond Price Prediction: Trends and Insights for 2025

HIBT Bond Price Prediction: Trends and Insights for 2025

According to Chainanalysis, as of 2025, over 73% of blockchain assets are expected to experience significant volatility. This raises concerns not only for individual investors but also for institutional players in the market. Navigating through these complexities, the HIBT bond price prediction becomes essential for smart investing.

What Factors Influence HIBT Bond Prices?

Let’s think of HIBT bonds like a yield-producing fruit tree. Several environmental factors affect their growth, including market demand, interest rates, and geopolitical stability. For instance, when are yields expected to rise? Global inflation trends or central bank policies can create waves that push bond prices up or down.

How Do Regulatory Trends Affect HIBT Bonds?

Similar to how new shop regulations can impact your local market, upcoming regulations on DeFi in regions like Singapore can significantly influence the performance of HIBT bonds. More concrete regulations could lead to a surge in investor confidence, hence boosting bond prices.

The Significance of Interoperability in the HIBT Market

Picture a currency exchange booth; interoperability allows different currencies – or in this case, blockchain networks – to interact seamlessly. This interaction enhances HIBT liquidity, making them more attractive to investors, which can lead to higher bond prices down the line.

Future Predictions for HIBT Bonds: What Does 2025 Hold?

As we gauge the future, we can think of market predictions like weather reports. Although not foolproof, various indicators can provide a forecast. Tools like CoinGecko’s analytics can help predict bond price trends, allowing investors to make more data-informed decisions.

In conclusion, understanding the HIBT bond price prediction involves grasping multiple market dynamics, regulatory influences, and technological advancements. For those looking to safeguard their investments, utilizing tools like Ledger Nano X can reduce the risk of key exposure by up to 70%.

For a comprehensive analysis and actionable insights, download our investment toolkit today!

View the bond price security whitepaper

Disclaimer: This article does not constitute investment advice. Please consult local regulatory authorities (e.g., MAS or SEC) before making investment decisions.