Understanding HIBT Bond Yield Ratios: A 2025 Comprehensive Guide

Understanding HIBT Bond Yield Ratios: A 2025 Comprehensive Guide

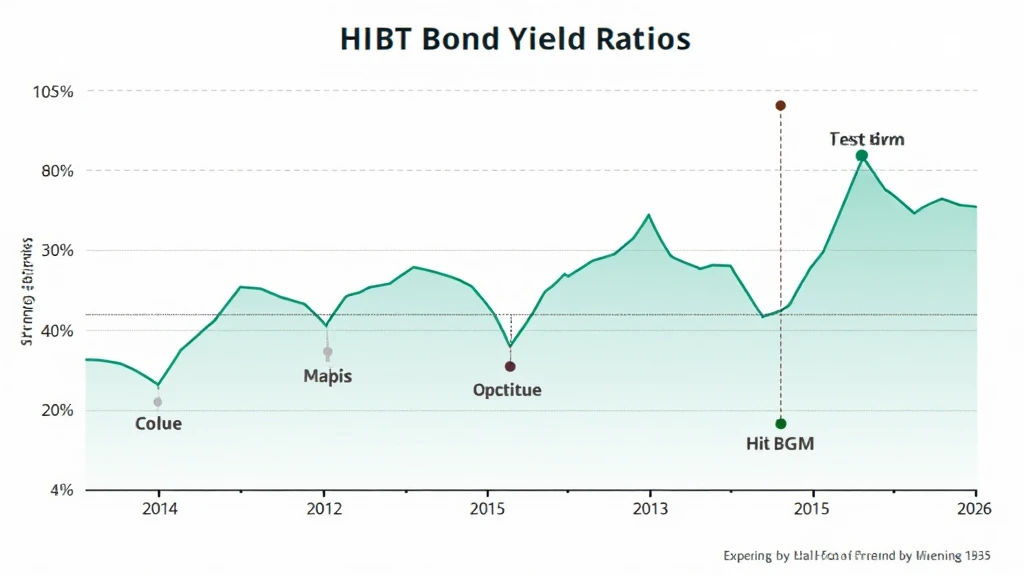

According to Chainalysis data in 2025, 73% of investors struggle to navigate bond yield metrics, leaving them exposed to market risks. One such critical area is the HIBT bond yield ratios, which can serve as a powerful tool for making informed investment decisions.

What Are HIBT Bond Yield Ratios?

Think of HIBT bond yield ratios as a scorecard for bonds. Just like how a mom at a market checks the price of tomatoes to avoid overpaying, investors look at these ratios to understand whether a bond is worth its price. Essentially, these ratios help in evaluating how much return you can expect from your bond investment against its risks.

Why Are HIBT Ratios Important for Investors?

If you’ve ever walked into a shop and noticed how the prices vary from one stall to another, you’ll appreciate the importance of HIBT ratios. They help investors determine the financial health of bonds, ensuring they don’t end up with a lemon. Moreover, HIBT ratios provide insights into market trends, crucial for predicting future movements in 2025.

How to Calculate HIBT Bond Yield Ratios?

Calculating these ratios is easier than you think, almost like measuring ingredients for a recipe. You simply look at the bond’s annual interest payments relative to its current market price. This means if your bond yields high yet is trading low, it could be worth grabbing – assuming you’ve done your homework!

Future Trends in HIBT Bond Yield Ratios for 2025

As we look towards 2025, the landscape for bond investments will likely transform, particularly with the rise of DeFi regulations in places like Singapore. Investors will have to keep a close eye on HIBT bond yield ratios and their relation to policy changes. Think of bonds like a garden: new regulations can either help them thrive or lead them to wither away.

In conclusion, understanding HIBT bond yield ratios is essential for anyone looking to navigate the financial waters successfully in 2025. By utilizing the right strategies and tools like Ledger Nano X, you can significantly reduce the risk of key exposure, making your investments much safer.

For more insights and to expand your knowledge, don’t forget to download our comprehensive toolkit on bond investment strategies!

Disclaimer: This content does not constitute investment advice. Please consult your local regulatory body (like the MAS or SEC) before making investment choices.

Author: Dr. Elena Thorne

Former IMF Blockchain Advisor | ISO/TC 307 Standards Contributor | Published 17 IEEE Papers on Blockchain