A Comprehensive Review of HIBT Cash Flow Statement: Insights for Investors

Understanding the Importance of HIBT Cash Flow Statement

Have you ever wondered how digital currencies manage their finances? With over 5.6 billion global cryptocurrency holders, it’s essential to understand the underlying financial statements of your investments. The HIBT cash flow statement is a crucial tool that provides insights into the operations of HIBT, showcasing how money is generated and utilized. In this article, we will dive into the HIBT cash flow statement and its implications for investors.

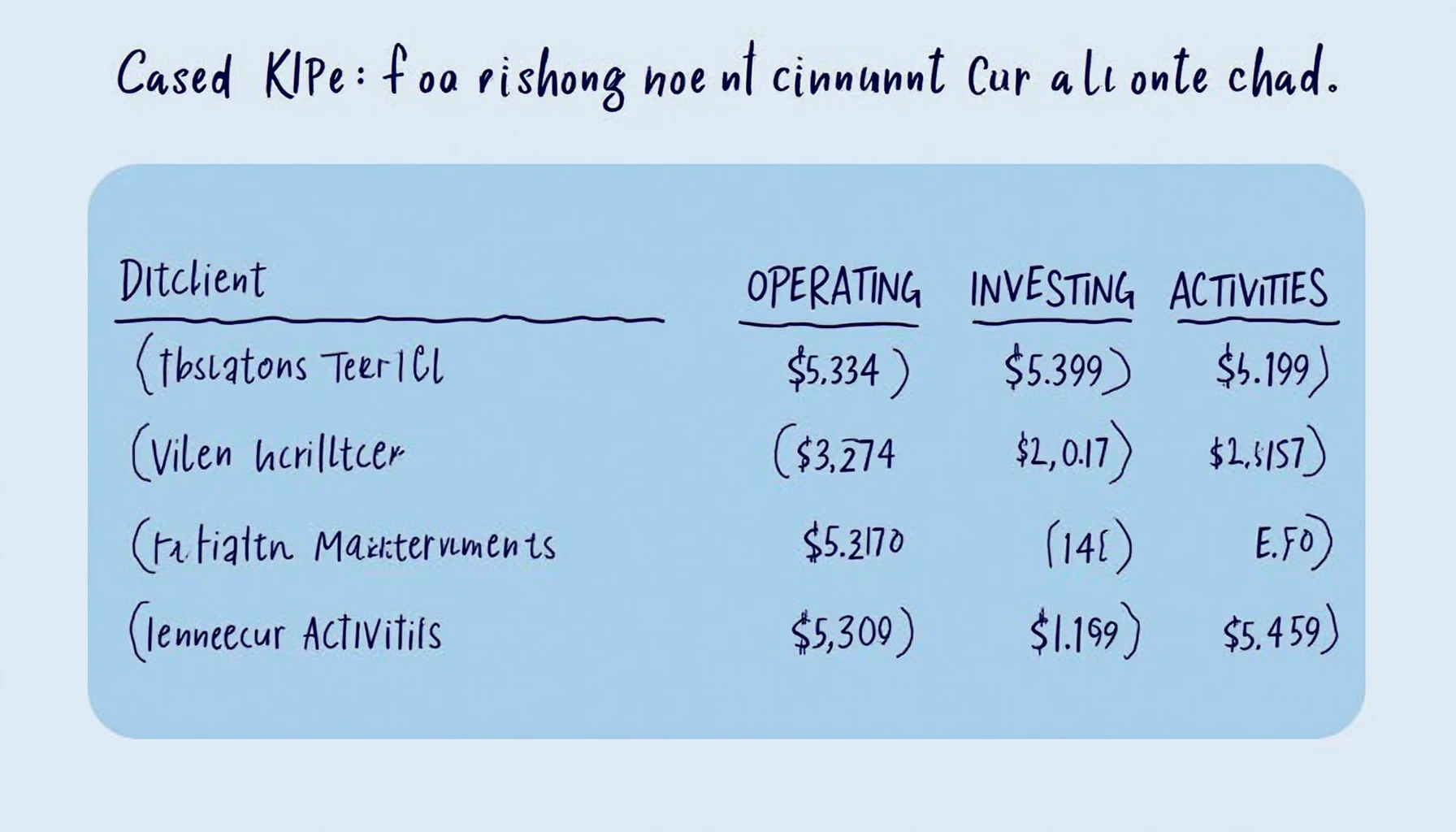

What Does the HIBT Cash Flow Statement Entail?

The cash flow statement for HIBT is broadly categorized into three sections: operating activities, investing activities, and financing activities. Each section plays a pivotal role in illustrating how HIBT manages liquidity and short-term financial health. To put it simply: think of HIBT as a grocery store. Just as the store earns money from sales (operating activities), spends on new inventory (investing activities), and manages its cash reserves (financing activities), HIBT does the same with its digital assets.

Operating Activities: The Core of HIBT’s Revenue

The operating activities section highlights the primary revenue-generating operations, like digital currency transactions and fees. It’s worth noting that operating cash flow can be influenced by market conditions and investor sentiment. For example, according to the latest Chainalysis 2025 report, the Asia-Pacific trading volume is projected to grow by 40%, indicating a potential rise in HIBT’s earnings.

Investing Activities: Strategic Resource Management

This section provides a glimpse into how HIBT invests in new technologies and partnerships. For instance, acquiring blockchain technology for better scalability or investing in security measures can enhance its overall performance. It’s similar to how a farmer might invest in better equipment to yield a larger harvest; strategic investments can lead to long-term benefits.

Financing Activities: Cash Flow Management

Financing activities cover fundraising, loans, and any repayment of debts. When HIBT issues new tokens or seeks external financing, understanding these cash flows can help you assess its financial stability. For potential investors, such transparency is crucial in making informed decisions.

Why Should Investors Care About HIBT Cash Flow Statement?

Being informed about the cash flow statement is essential for assessing HIBT’s long-term sustainability. Monitoring cash flow helps investors gauge whether the company can fund its operations and achieve growth initiatives effectively. If you’re considering investing in HIBT or similar cryptocurrencies, understanding this statement should be on your checklist.

Moreover, this statement indicates the operational efficiency of HIBT, which is increasingly significant as the cryptocurrency market evolves. Remember, just like the grocery store needs to keep its cash flowing to survive, so does HIBT.

Conclusion: Making Educated Investment Decisions

To sum up, the HIBT cash flow statement is an invaluable resource for investors looking to dive into the digital currency realm. By analyzing its operating, investing, and financing activities, you can gain insights into HIBT’s overall financial health and make educated decisions about your investments. Remember, this information serves as a foundation for understanding the intricacies of your chosen assets.

For those keen on maximizing their investment strategies in the digital landscape, downloading our comprehensive guide on cash flow analysis is a step in the right direction. Don’t miss the opportunity to empower yourself with crucial financial information that could help secure your investments.

Disclaimer: This article does not constitute investment advice. Always consult with local regulators before making financial decisions.

For more informative content like this, visit HIBT, and enhance your understanding of cash flow management in digital currencies.